Contents

- 1 1- Why a professional bank account for small business accounting?

- 2 2- Accounting set-up and implementation

- 3 3- Accounting tools and systems for small businesses

- 4 4- Security and confidentiality of accounting data

- 5 5- Financial transaction analysis for small and growing businesses

- 6 6- Accounting training and support

- 7 7- Partnership and collaboration in accounting management

- 8 8- Do you need an accountant for a small business?

- 9 FAQ : Accounting for small business

This task enables small business owners to monitor and manage their finances effectively, particularly in the early days. As well as providing information on the past and present performance of the business, accounting also facilitates tasks such as invoicing, tracking business expenses, monitoring income and wages in order to monitor business income, business assets and the financial health of the business. Accounting tasks can be cumbersome and time-consuming for a business owner. So it’s time to ask yourself the following question: How do you do accounting for small business?

What is fundamental?

First of all, it is fundamental to start by choosing accounting software such as Finotor from Finotor Innovation LTD, a global accounting firm with accounting services (Neotoria) – free accounting software to try – used by small business owners, the self-employed, new entrepreneurs or even large companies for small business accounting.

So business owners need to master the basics of bookkeeping and know what bookkeeping is. This is essential if they are to manage their business more effectively. They will have no choice but to take a minimum amount of training if they want to have a good grasp of their performance indicators, adapt the company’s structure and act quickly accordingly.

1- Why a professional bank account for small business accounting?

A first element, and above all the starting point for small business accounting, is to have a separate business bank account and bank statements in the name of the business. Never use a personal bank account for a business activity.

It will also be necessary to link the income accounts to the incoming flows visible in the bank accounts.

There are several criteria for having a business bank account:

- Comply with the law: Depending on the legal structure of the business, it may be compulsory to have a separate business bank account.

- Display a professional profile: Having a separate business bank account lends a certain professionalism to the business and allows business finances to be kept separate from personal finances.

- Keep accounts: A separate business bank account makes it easier to manage and monitor business finances. It simplifies bookkeeping and accounting for small businesses, makes it easier to prepare financial statements and tax returns, and reduces the risk of errors.

- Makes it easier to obtain loans and credit: a business bank account shows that the business is legitimate and can help establish a credit history. This can make it easier to obtain loans and credit in the future.

- Increased legal protection: A separate business bank account for small businesses can offer some protection against liability. In the event of legal action, it can be easier to prove that the business is a separate entity from the owner(s).

Overall, opening a small business bank account is a smart business practice that can help ensure compliance, enhance professionalism, simplify accounting, establish credit and provide protection.

2- Accounting set-up and implementation

Setting up and implementing accounting is a crucial step for any small business. Choosing the right accounting system for your needs and configuring it correctly are essential to ensuring that your finances are managed efficiently. Here are a few steps you can take to set up your company’s accounting system:

- Define your accounting goals and needs: Before you begin, it’s important to determine what you want to accomplish with your accounting system. This could include tracking expenses, managing invoices or preparing tax returns.

- Choosing the right accounting system for your business: Whether you opt for online accounting software such as Finotor or a manual system, make sure it meets your specific needs.

- Configure the accounting system: Once you’ve chosen a system, configure it to reflect the structure of your business. This includes creating accounts for different categories of expenditure and income.

- Set up procedures for entering and managing financial transactions: Establish clear procedures for recording transactions to ensure consistency and accuracy.

- Train employees: Ensure that all employees involved in accounting are trained in the use of the system and the established procedures. This ensures that your company’s accounting is managed smoothly and efficiently.

3- Accounting tools and systems for small businesses

There are many accounting tools and systems available for small businesses. Here are some of the most popular:

- Online accounting software: Solutions such as QuickBooks, Xero or Wave offer comprehensive functionality for managing finances, including invoicing, tracking expenses and producing financial statements.

- Manual accounting systems: For those who prefer a more traditional approach, ledgers or spreadsheets can be used to record transactions.

- Mobile accounting applications: Applications such as Expensify or Shoeboxed allow expenses to be tracked on the move, providing additional flexibility.

- Integrated accounting systems: Some business management software, such as ERP or CRM, incorporates accounting functionality, allowing centralised management of operations.

It is important to choose an accounting tool or system that meets your specific needs and is easy to use. A good accounting system can simplify financial management and improve the efficiency of your business.

4- Security and confidentiality of accounting data

The security and confidentiality of accounting data are essential for any business. Here are some steps you can take to protect your accounting data:

- Use strong, unique passwords: Ensure that all access to the accounting system is protected by strong, regularly updated passwords.

- Set up regular back-up procedures: Back up your accounting data regularly to avoid any loss of data in the event of a technical problem.

- Use security software: Protect your systems against viruses and malicious software by using reliable security software.

- Limit access to the accounting system: Only employees who need access to accounting data should have the necessary authorisations.

- Use encryption protocols: Protect accounting data during transmission by using secure encryption protocols.

By taking these steps, you can ensure the security and confidentiality of your company’s accounting data, reducing the risk of fraud and data loss.

5- Financial transaction analysis for small and growing businesses

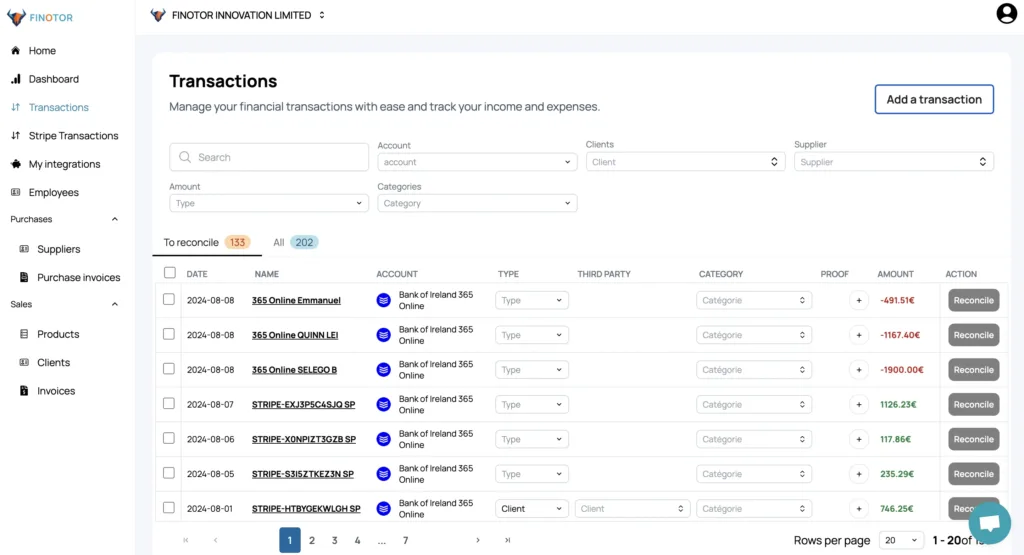

Keeping track of a small business starts with analysing the company’s financial statements to make sure they relate to the business entity. So choose effective accounting software like Finotor.

Personal loans, for example, are not included in the company’s accounting and financial accounts. Source documents form the basis for recording transactions and are prepared at the first stage of the accounting process.

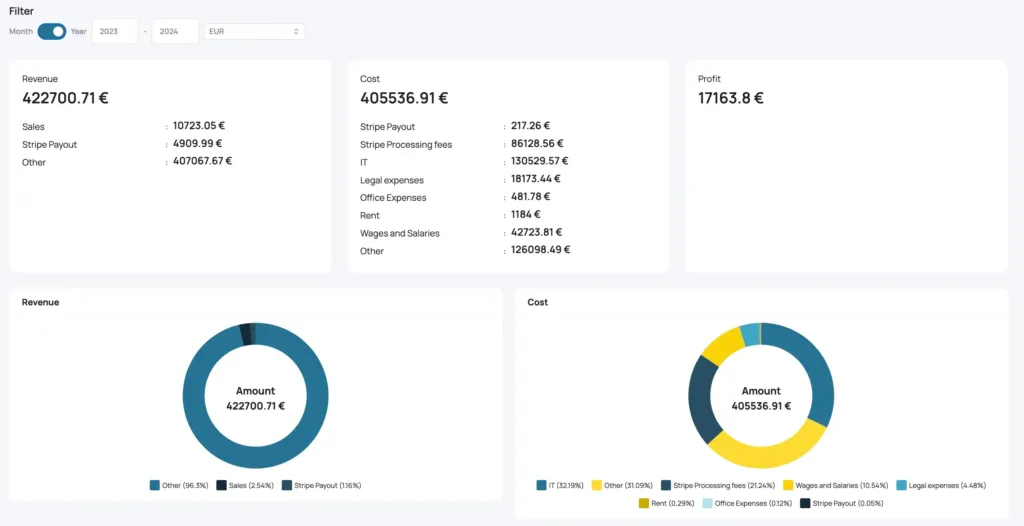

Analysis of a company’s financial transactions is important because it helps to understand the company’s financial position and to identify trends and potential problems. It also enables compliance with accounting and tax standards to be verified.

The analysis of financial transactions should include the following elements:

- Accounting records: this is a list of the company’s financial transactions, recorded in the accounting journals and bookkeeping. The accounting records should be organised by category of account (assets, liabilities, equity, income, expenses) to allow detailed analysis.

- Financial statements: these include the balance sheet, income statement and cash flow statement, which are generated from the accounting records. The financial statements provide an understanding of the company’s financial position at a given point in time and its evolution over time.

- Financial ratios: these include key financial indicators, such as the liquidity ratio, profitability ratio, debt ratio, etc. Financial ratios make it possible to compare a company’s performance with that of other companies in the same sector.

Analysis of financial transactions is effective when it is based on accurate, up-to-date data. It must be carried out on a regular basis to enable an ongoing assessment of the company’s financial situation. It must also be carried out by professionals who are competent and experienced in accounting and financial analysis.

Journal entries

The business transactions of small businesses are recorded in a journal, or book of original entries, using the double-entry system. Journal entries comprise two accounts – debit and credit. To streamline this process, accountants use special journals to record recurring transactions such as purchases, sales and receipts. Transactions that cannot be included in the special journals are recorded in the general journal.

The general ledger for a small business

The general ledger, also known as the books of final entries, is a set of accounts that shows the changes made to each account based on past transactions, as well as the current balances of each account.

The general ledger is an accounting document that traces and records all the financial transactions carried out by a company over a given period. It is considered to be one of the most important documents in a company’s accounting system.

The general ledger is useful for several reasons:

- Firstly, it allows the company’s account balances to be tracked, which is important for the preparation of accurate financial statements.

- Secondly, it facilitates the analysis of company transactions, making it possible to detect errors, omissions or fraud.

- In addition, the general ledger makes it possible to check that all accounting entries comply with the accounting rules in force. Finally, it facilitates the preparation of tax returns and other legal obligations.

Having an up-to-date ledger is essential for the financial management of your business. It provides reliable, up-to-date information on the company’s financial situation, facilitates decision-making and helps to manage financial risks.

It can also help detect accounting errors and possible fraud, which can have serious consequences for the company’s financial health.

Unadjusted trial balance

The unadjusted trial balance is an accounting tool used to verify the accuracy of a company’s accounting records. It shows the balances of accounts receivable and accounts payable on a given date and ensures that the debit and credit totals are in balance.

The unadjusted trial balance is useful for several reasons:

- Firstly, it allows you to quickly and efficiently check the accuracy of your company’s accounting records by comparing debit and credit totals.

- It also allows you to detect any input or accounting errors that may have crept into the accounting entries.

- The unadjusted trial balance is a basic tool for preparing a company’s financial statements. It ensures that accounting records are complete and accurate, which is essential for preparing accurate financial statements.

- It enables accounting errors to be detected quickly and corrected before they have a significant impact on the company’s financial position.

It is therefore important that the unadjusted trial balance is up to date with the accounting entries, as it provides reliable and up-to-date financial information on the company’s situation. This facilitates financial decision-making and risk management.

Adjusted trial balance

At the end of an accounting period, adjusting entries are made to update the accounts summarised in the financial statements. Adjusting entries may include income and expense accruals, depreciation, provisions, deferrals and prepayments.

An adjusted trial balance is then prepared to check that the debits and credits match after the adjusting entries have been made, which is the final step before the financial statements are prepared.

The adjusted trial balance is an accounting tool that verifies the accuracy of a company’s accounting records, but after the necessary adjustments have been made. It shows the balances of accounts receivable and payable at a given date, after taking into account end-of-period adjustments.

Financial statements

For small businesses,the end products of the accounting system are the financial statements, including the income statement, statement of changes in equity, balance sheet, cash flow statement and notes.

Closing of registrations

The final step in the accounting cycle is to close temporary accounts, such as income, expense and withdrawal accounts, in order to prepare the system for the next accounting cycle. Balance sheet accounts, also known as permanent accounts, remain open.

Once the closing entries have been made, a post-closing trial balance is prepared to check that the debits and credits in the real accounts are equal, since the temporary accounts have been closed for the current accounting cycle.

To set up an accounting system for small businesses, open a separate bank account for your company’s finances and choose accounting software such as Finotor. With an accounting application for small businesses, you also need to choose a method of recording financial transactions, such as cash or accrual accounting.

The cash and accrual methods of accounting for small businesses

The cash method records income and expenditure only when cash transactions take place. In contrast, most businesses opt for accrual accounting, which records income when a sale is made and expenses when they are incurred, regardless of cash transactions. A double-entry bookkeeping system is used to record two entries for each transaction.

Recording operations

As a small business owner, it is important to accurately record your company’s transactions so that you have a clear picture of your finances. You have a number of options when it comes to recording transactions, including hiring an accountant, recording transactions manually or using accounting software.

Determining payment terms

As well as drawing up a chart of accounts, it’s important to determine the terms of payment for a small business. Depending on the nature of your business, you may decide to offer credit to your customers. In this case, you will need to set up a consistent system for issuing and sending invoices to customers. This will ensure that you are paid on time and that your company’s cash flow remains healthy.

Determining the terms of payment is a step that lends credibility to the business, as it enables the relationship between customer and supplier to be organised in a professional manner.

It enables a company to define the terms of payment for its customers. Payment terms include payment periods, payment deadlines, any late payment penalties, early payment discounts and other payment conditions.

Payment terms should include the following elements:

- Terms of payment: this refers to the period of time the customer has to pay the invoice, usually expressed as a number of days (e.g. 30 days).

- Payment methods: This refers to the different payment methods accepted by the company, such as bank transfers, cheques or online payments.

- Late payment penalties: These are fees or interest charged if the customer fails to meet the agreed payment terms.

- Early payment discounts: This is a price reduction offered if the customer pays the invoice before the due date.

- Other payment terms: These may be specific terms relating to the nature of the transaction or the business relationship between the company and the customer.

6- Accounting training and support

Training and support are essential for any business wishing to manage its accounts effectively. Here are some of the resources available for accounting training and support:

- Online or face-to-face accounting courses: Many institutions offer courses to help entrepreneurs understand the basics of accounting.

- Accounting manuals and guides: Practical books and guides can provide detailed information on accounting management.

- Technical support and online assistance: Accounting software such as Finotor often offers technical support to help users resolve problems.

- Advice and guidance from accountancy professionals: Calling on the services of professional accountants can offer invaluable advice and personalised guidance.

- Networks of accountancy professionals: Joining networks or associations of accountants can allow you to share best practice and acquire new knowledge.

By investing in training and support, you can improve your company’s accounting management and ensure greater accuracy and efficiency.

7- Partnership and collaboration in accounting management

Accounting for a small business can be a complex and time-consuming task. It is often useful to work in partnership with accountancy professionals for advice and support. Here are some of the benefits of working in partnership with accountancy professionals:

- Access to specialist knowledge and experience: Professional accountants have in-depth expertise that can benefit your business.

- Advice and guidance on setting up and managing your accounts: They can help you set up your accounting system and establish effective procedures.

- Technical support and online assistance: Professionals can provide ongoing support to resolve technical problems and answer questions.

- Reduced time and costs associated with accounting management: By delegating certain accounting tasks, you can concentrate on other aspects of your business.

- Improved accuracy and reliability of accounting data: Professional accountants can ensure that your data is accurate and complies with accounting standards.

By working with professional accountants, you can improve the financial management of your business and ensure that your finances are in order.

8- Do you need an accountant for a small business?

Running a small business requires a variety of skills, including financial management. An entrepreneur or business owner must have a minimum knowledge of business management and accounting.

If this is not the case, it is possible and advisable to use chartered accountants, accounting services and solutions such as Finotor for small businesses. Working with a professional firm like Administration G. Perreault Inc. can improve the efficiency and professionalism of accounting and payroll processes.

When setting up your business, for most small business owners, an accountant can help you develop a business plan and even advise you on areas of concern and opportunities.

With the help of solutions such as Finotor, accounting software for small businesses, you can :

- Advise you on the entity structure of your business. This is important because it can have major consequences if it is not properly organised.

- help you obtain the authorisations you need to run your business, such as business licences, sales tax authorisations and employment accounts

- Manage your business more efficiently with Finotor accounting software. When you don’t want to use the services of an accountant on a regular basis, Finotor allows you to be autonomous and therefore save on this expense.

- Deal with compliance issues and complex sales tax problems

- Manage complex labour costs, including payroll compliance issues that can sink even the most profitable businesses.

- help you meet the requirements of creditors or licensing bodies

- Maintain inventory records by purchase date, stock number, purchase price, sale date and sale price.

Another area where an accountant can be of great help is in payroll costs. He or she can ensure that you comply with wage and labour laws, and help you manage employee wages and benefits.

Small business owners who can’t afford to hire an accountant can opt to automate their accounting department with online accounting software such as Finotor.

These applications, and in particular Finotor, the best accounting software for small businesses, offer features such as invoicing, payments and payroll, and can help business owners keep accurate records and create basic financial statements. Finotor – the best accounting software – allows you to connect your banks and credit card collection tools for small businesses.

This is because most accounting software for small businesses does not provide full functionality such as openbanking, OCR to digitise invoices and expense reports, or contextualised AI to analyse financial data.

In conclusion, whether you decide to hire an accountant or use accounting software, it’s always important to have a system in place to manage your small business finances and secure financial transactions. Good financial management supported by accounting software like Finotor can help you make informed decisions and keep your business on the road to success.

Finotor’s powerful tools and features offer a simple and secure way to manage small business finances. With Finotor, you can easily track expenses, generate invoices, view performance analysis and much more. What’s more, the software is cloud-based, so it can be accessed from anywhere with an internet connection and offers superior security for all your financial data.

FAQ : Accounting for small business

- What is accounting for small business?

Accounting for small business involves keeping track of all financial transactions, managing expenses and income, and ensuring that the business meets its tax obligations. - Why is accounting important for a small business?

It helps to monitor the financial health of the business, make informed decisions, meet tax obligations and optimise resource management. - What are the essential tools for managing the accounts of a small business?

Software such as Finotor can simplify accounting management by automating the invoicing process, tracking expenses and producing financial statements. - How can I keep my small business accounts efficiently?

It’s important to use reliable accounting software, to keep regular track of income and expenditure, and to reconcile accounts every month to avoid errors. - Do I need an accountant for my small business?

It depends on how complex your finances are. If you are just starting out or have some knowledge of bookkeeping, tools such as Finotor may suffice. However, an accountant can be useful for tax advice or in the event of an audit. - What are the common mistakes to avoid in bookkeeping for a small business?

Common mistakes include neglecting to keep track of invoices, forgetting to reconcile bank accounts, and failing to document business expenses. - What are the advantages of using software like Finotor for small business accounting?

Finotor offers automation features, smooth bank integration, real-time financial statement production and simplified invoice management, all of which help to save time and avoid errors. - What accounting documents are essential for a small business?

Essential documents include invoices, bank statements, sales reports, expense records and tax returns. - How can I keep track of small business expenses?

Use software like Finotor to automatically track expenses, classify transactions and keep receipts for all business expenses. - How can I simplify my small business accounting?

Adopt an online accounting system like Finotor, which can automate repetitive tasks, generate financial reports, and make it easier to manage accounts and tax returns.