Contents

- 1 It can save time by automating tasks such as invoicing and payments with a accounting software

- 2 It can help you keep track of your finances and budget better

- 3 It can make tax season less stressful by organizing your records in a accounting small business software

- 4 It can give you insights into your business’s performance

- 5 Accounting software is affordable and easy to use, even for those without an accounting background

- 6 Accounting software : a great solution for small business owners ?

- 7 Entrepreneur, accountant, bookkeeper, Finotor solution is for you

- 8 Many accounting software programs offer a free trial period

- 9 Accounting software can help you keep track of your income and expenses

- 10 Some accounting software programs can also help you prepare for tax season

- 11 Accounting software can save you time by automating some of the tasks associated with bookkeeping

- 12 When choosing an accounting software program, be sure to consider your specific needs as a small business owner

- 13 All-in-one solution for accounting and financial managing

- 14 Why accounting software for expense tracking?

- 15 Why accounting software for inventory management?

- 16 Could I use Excel as an accounting software?

- 17 Pros of using Excel for accounting instead of accounting software :

- 18 Cons of using Excel for accounting instead of accounting software

- 19 Is Finotor en ligne right for you or your business?

- 20 Can a small business do their own bookkeeping with an accounting software?

- 21 Can I do my own small business accounting?

For small businesses, keeping track of spending and income can be a daunting task. But by using accounting software or simply software for small businesses, you can stay on top of your finances and make life easier for yourself and your bookkeeper. In this blog post, we’ll explore how accounting software can be useful for a small business. We’ll also touch on some of the different features that accounting software offers, so you can decide if it’s right for you. Thanks for reading!

It can save time by automating tasks such as invoicing and payments with a accounting software

Keeping accounting records for a small business can be time consuming and tedious with software for small businesses. But accounting software designed specifically for small businesses can revolutionize the accounting experience. Automating tasks such as invoicing and payments using accounting small business software can save valuable time and effort, allowing owners to focus on other aspects of their business instead of paperwork. This will free up their energy to invest in growth opportunities or take more time out of the office while still keeping their accounting on track.

It can help you keep track of your finances and budget better

Working on accounting and budgeting can seem overwhelming though it doesn’t have to be. Investing in accounting software specifically designed for small businesses is an excellent tool to help keep better track of finances. Such software allows you to easily record transactions, track inventory, review accounting reports, and manage payroll—all without extensive accounting knowledge.

It also provides quick insights into how your business or organization is doing, offering the tools necessary to stay organized and comply with applicable laws. Accounting software can help make finance-related tasks simpler and more efficient, so you have more time available to focus on the core objectives of your business or organization.

It can make tax season less stressful by organizing your records in a accounting small business software

Tax season can be a stressful time and tedious accounting tasks for small business owners. Having good accounting practices to keep track of all income, expenses, and deductions is essential to filing accurate taxes and minimize the amount owed. One way to manage this accounting more easily and reduce stress during tax time is by using accounting software that automatically organizes your financial records in one secure place.

Researching the various accounting software programs available can equip you with the knowledge you need to make an informed decision about which one is best for your business. Investing in accounting software now can save you from headaches when it comes time to do your taxes later.

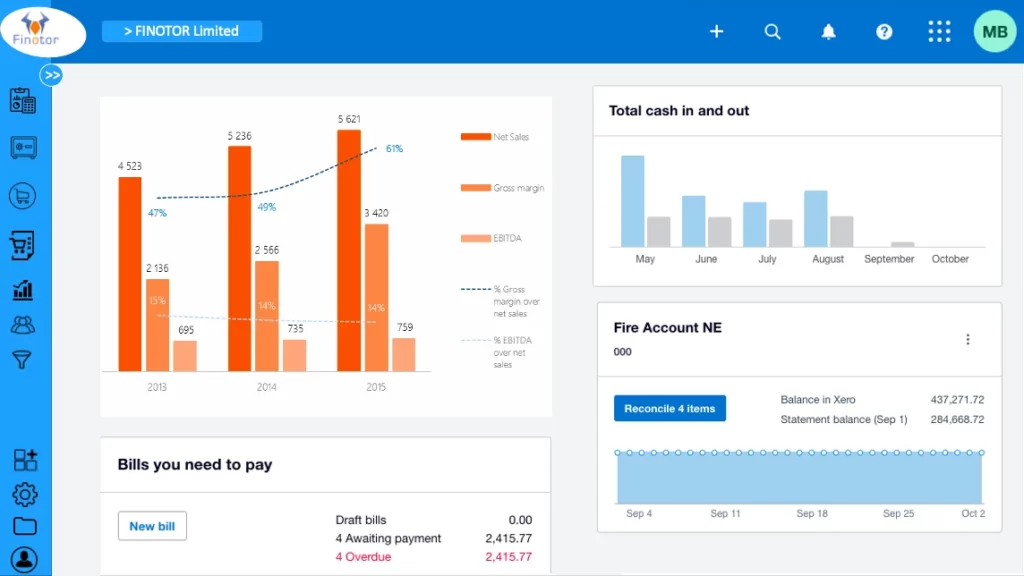

It can give you insights into your business’s performance

Having accounting small business software is essential for any business looking to track and monitor their performance. Having insights into your business’s performance can give you a better idea of what areas are successful, which need improvement, and how to maximize efficiency.

This type of data allows you to make strategic decisions quickly and effectively, as it provides evidence-based feedback on your progress. Fortunately, accounting small business software makes gathering this type of valuable insight easier than ever. By utilizing accounting software, you will be able to gain transparency into the status of your business with little effort or time commitment.

Accounting software is affordable and easy to use, even for those without an accounting background

Accounting software provides an affordable and straightforward accounting solution for small businesses, even if you don’t have an accounting background and accounting tasks are made easier with Finotor and you have access to detailed financial reporting. The setup process is simple and intuitive, with features designed to help streamline time-consuming accounting tasks. Plus, it’s often compatible with existing business technology tools.

For entrepreneurs that need accounting support without the big price tag, accounting software is a great option worth exploring. Whether you are just getting started or simply looking for a more efficient accounting system for your small business, accounting software can prove invaluable.

Accounting software : a great solution for small business owners ?

Overall, accounting software is a great solution for small business owners who want to save time and money. It can automate tasks, help you keep track of your finances, and make tax season less stressful. It’s also affordable and easy to use, even for those without an accounting background. If you’re looking for a quality accounting software solution, be sure to try Finotor.

There are several accounting software providers, but Finotor is ahead of the curve in using accounting data for financial analysis. This for business owners and entrepreneurs.

Our team specializes in providing real-time financial data so that you can make the best decisions for your business. Plus, we offer a free trial so that you can see how our software can benefit you firsthand. No matter what stage your business is in, Finotor can provide valuable insights into your performance. So why wait? Try Finotor today and see how we can help take your business to the next level!

Entrepreneur, accountant, bookkeeper, Finotor solution is for you

Are you a small business owner? Do you feel like you’re constantly behind on your accounting and bookkeeping? Well, you’re not alone. Many small business owners struggle to keep up with their accounting, which can lead to missed opportunities and even fines. But there is hope!

Accounting software can be a useful tool for small businesses, providing an easy way to track income and expenses. In this blog post, we’ll explore how accounting software can help your small business stay organized and compliant. Whether you’re just getting started or have been in business for years, read on to learn more about how accounting software can benefit your business!

Many accounting software programs offer a free trial period

For small business owners, the search for small business accounting software can be difficult and time consuming. With so many great options available in the market, taxes and financial complexities can seem overwhelming—but help is here! In recent years, free accounting software programs have become increasingly sophisticated with small businesses in mind.

Nearly all these software programs offer a free trial period for users to sample their features before making a purchase decision. This kind of trial feature offers small business owners the unique opportunity to experiment with different programs until they find one that fits their needs perfectly. Ultimately, taking advantage of this free trial period will enable small business owners to make an informed decision about which small business accounting software is most beneficial.

Accounting software can help you keep track of your income and expenses

Small business owners can benefit greatly from small business accounting software and software for small businesses, as it provides a simple and efficient way to organize and track their income and expenses. Accounting software features including expense and income tracking. With small business accounting software, small businesses can keep track of invoices or pay bills, generate reports on financial performance, reconcile accounts, create budgets, plan financial projections and much more. The software assists small business owners in meeting the challenging demands of small business bookkeeping.

Not only does small business accounting software save time compared to manual bookkeeping methods, but it also ensures greater accuracy in your financial records. With small business accounting software, small businesses are able to stay on top of their finances so that they can make informed decisions about the future of their businesses without having to worry about things getting out of hand financially.

Some accounting software programs can also help you prepare for tax season

Small business accounting software is a great way to prepare for tax season, as it allows small business owners to easily and accurately keep track of their expenses and income throughout the year. This ensures that small business owners have all of the vital information they need when it comes time to file taxes – no more guesswork! Not only that, but the software can even help small business owners go further by suggesting ways to further optimize their finances so they can save more during tax season. All in all, small business accounting software is an invaluable tool during this crucial time, offering users convenience and knowledge necessary for successful filing.

Accounting software can save you time by automating some of the tasks associated with bookkeeping

For small business owners, the tedious task of bookkeeping doesn’t have to take hours upon hours out of their schedule. Today, small businesses can take advantage of small business accounting software to make life easier. Automating processes used in bookkeeping such as tracking income and expenses, generate invoices and manage accounts receivable can help small businesses maintain accurate financial records while saving time.

Not only does this give small business owners more time to dedicate to what really matters – growing their company – but also it allows for more accuracy when it comes to their financial data. Accounting software can be a game changer for small businesses; automating processes associated with bookkeeping can help small companies work smarter and save time.

When choosing an accounting software program, be sure to consider your specific needs as a small business owner

As a small business owner, selecting the best accounting software program and free accounting software for your business needs can be daunting. However, by thoroughly considering all aspects of the small business environment such as expected growth rate, willingness to invest in technology and consider external factors such as cost of setup and ongoing maintenance activities, you will be able to decide on the ideal small business accounting software package for your specific requirements. A comprehensive evaluation of the advantages and disadvantages should include criteria such as usability to determine if each small business accounting software package is right for your small company’s present needs and future goals.

All-in-one solution for accounting and financial managing

If you’re thinking of using free accounting software to manage your finances, remember that many programs offer free trials and many software for small businesses, but Finotor solution is the best way to have a real efficient tool – All the solutions, indicators, analyses, the bank, the cash flow plan, and multiple entrepreneurial decision aids are in a single dashboard. This gives you an opportunity to try out the features of each program and find the one that works best for you and your business. Accounting software can save you time by automating tasks such as income and expense tracking, and some programs can even help you prepare for tax season. Be sure to choose a program that meets your specific needs as a small business owner. Finotor offers a free trial so you can see how our solution can work for you. Click here to get started.

Why accounting software for expense tracking?

The online accounting software like Finotor solution is commonly used for expense tracking for several reasons :

-

The automation to gain time

Accounting software can automate many of the tasks associated with expense tracking, such as data entry, categorization, and reconciliation. This saves time and reduces the potential for errors.

-

To improve the organization of your company

Expense tracking software can help you keep all of your expenses organized in one place. This makes it easier to keep track of your spending and identify areas where you may need to cut back.

-

Real-time tracking for the manager

With accounting software of Finotor, you can track your expenses in real time. This allows you to see exactly where your money is going and make adjustments if necessary.

With accounting software, you can track your expenses in real time. This allows you to see exactly where your money is going and make adjustments if necessary.Reporting: Expense tracking software can generate reports that provide valuable insights into your spending habits. These reports can help you identify areas where you may be overspending or where you can cut back.

-

Promote integration with other tools

Many accounting software programs, especially Finotor, can integrate with other financial tools, such as bank accounts and credit cards. This makes it easier to track all your financial information in one place.

-

You can also connect business bank accounts

The tracking of expenses and cash flow will be greatly facilitated by the connection between the business bank accounts and the cash flow plan

So using accounting software solutions like Finotor solution to track expenses can help you better manage your finances and make informed decisions about business expenses. Managers or accountants can have an accurate and efficient view of these accounting and financial indicators to make the right decisions at the right time. But an important element is the speed of decision making for a business head. It is not a matter of putting the right things in place or implementing a strategy late. To act late is to act too late!

Why accounting software for inventory management?

The Finotor online accounting software is commonly used for inventory management for several reasons:

-

Automate the Inventory management

Inventory management with Finotor can automate many of the tasks associated with inventory management, such as tracking inventory levels, generating purchase orders, and managing stock transfers. This saves time and reduces the potential for errors.

-

Real-time tracking of the Inventory

With Finotor, the real-time is very important to track your inventory. This allows you to see exactly how much stock you have on hand, where it is and when you need to reorder it. This way, you don’t have too much cash tied up or out of stock.

-

Inventory Data Accuracy

Inventory management software, like Finotor offers, can help a business ensure the accuracy of your inventory records. This is important for making informed business decisions, such as when to order more inventory or when to offer discounts to clear excess inventory more quickly.

-

Inventory cost tracking

With Finotor’s accounting software, you can track the cost of your inventory and determine which products are more profitable than others – this will allow you to make trade-offs in reorders. This information can help you make informed decisions about pricing, volume and inventory turnover.

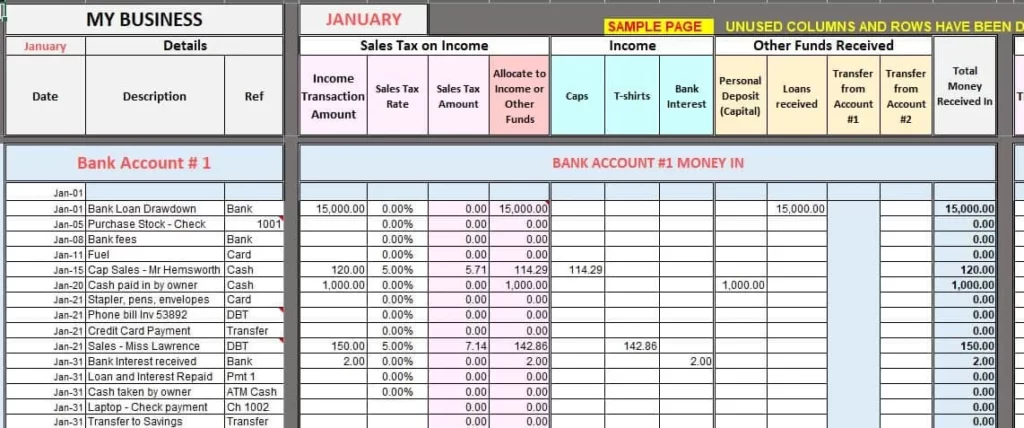

Could I use Excel as an accounting software?

Excel can be used as accounting software for small businesses with basic accounting needs. However, it may not be the best option for businesses with more complex accounting needs or high transaction volumes. It can be a very temporary solution for an entrepreneur who has just started his company to save some money before getting an accounting software very quickly. So here are some considerations to keep in mind if you are thinking of using an Excel sheet instead of accounting software.

Pros of using Excel for accounting instead of accounting software :

-

Flexibility

Excel provides flexibility to customize your accounting templates to your specific business needs, which may be useful for small businesses that have a limited budget for accounting software.

-

Cost-effective

Excel is widely available and typically already installed on most computers, which makes it a cost-effective solution for small businesses.

-

User-friendly

Excel is a widely used software, and it is generally easy to learn for most users.

Cons of using Excel for accounting instead of accounting software

-

The Manual data entry

Excel requires manual data entry, which can be time-consuming and can result in errors. As your business grows and the volume of transactions increases, this manual process can become more complex and challenging.

-

The Limited automation

Excel lacks automation features, which means that you will need to perform many accounting tasks manually, such as generating invoices, tracking expenses, and reconciling bank statements.

-

The Security

Excel files are generally not as secure as dedicated accounting software. You need to ensure that your files are properly backed up, and that you have adequate controls in place to prevent unauthorized access.

So, while Excel, free software, can be used as an accounting software, it may not be the best solution for all businesses – it does not produce Financial Reports for example. For larger businesses with more complex accounting needs or high transaction volumes, it is recommended to invest in a dedicated accounting software that can provide more automation, security, and functionality.

Finotor cloud accounting is designed for business owners, contractors, accountants, bookkeepers,… This tool will allow companies to get paid from their customers in a simpler, more efficient way while creating a trustworthy relationship with them in multiple businesses using financial reports for example.

The Finotor solution will allow you to edit and send invoices directly and faster, save time and be more efficient. The relevant management of the company’s finances in a single place will allow to have in a single view, a maximum of data and decision support.

With fully integrated double-entry accounting functions, available on any device, you can manage your accounting with ease, wherever you are and whenever you want.

Is Finotor en ligne right for you or your business?

Finotor en ligne is the best solution for many small businesses that want to avoid getting lost in complicated accounting. The value creation of a company is not in its accounting. Finotor is a facilitator for accounting and financial analysis. For entrepreneurs who want to facilitate customer billing, make invoice payments more efficient, and integrate information into accounting, using Finotor is obvious. Small businesses can use reduced functionality that meets their needs. This will reduce the subscription price.

Those who want to access their accounting from anywhere or while on the go will appreciate the ability to easily connect, especially through the mobile application. No need to have multiple tools, multiple connections, and therefore increase subscription costs.

Can a small business do their own bookkeeping with an accounting software?

Yes, a small business can do their own bookkeeping, especially if the business has basic accounting needs and limited transactions. Here are some advantages of doing your own bookkeeping:

-

Cost-saving for a small business finances

By doing your own bookkeeping, you can save money on accounting fees, which can be significant for a small business.

-

Control by the company itself

Doing your own bookkeeping gives you full control over your financial records and can help you better understand the financial health of your business.

-

Flexibility to be more agile

You can set up your bookkeeping system to fit your business’s specific needs and preferences.

-

Learning opportunity

Managing your own bookkeeping can provide an opportunity for you to learn more about accounting and improve your financial management skills.

-

New features

A company can create and adapt its own features to best meet the demands of its customers.

However, there are also some potential drawbacks to doing your own bookkeeping:

-

Time-consuming

Bookkeeping can be time-consuming, especially if you are not experienced in accounting. This can take time away from other important aspects of your business.

-

Complexity

As your business grows and your accounting needs become more complex, it may be more difficult to keep up with bookkeeping on your own.

-

Risk of errors

Doing your own bookkeeping increases the risk of errors, which can result in financial and tax-related problems.

A small business can do their own bookkeeping, but it is important to weigh the benefits and drawbacks and consider whether you have the time, skills, and resources to do it effectively. If your business has complex accounting needs or you are not comfortable with bookkeeping, it may be beneficial to seek the help of an experienced accountant or invest in accounting software.

Can I do my own small business accounting?

Yes, it is possible for a small business owner to do their own accounting. Doing your own accounting can be a cost-effective solution, especially for businesses with basic accounting needs and limited transactions. However, it is important to understand the responsibilities that come with accounting and ensure that you have the skills and resources needed to do it effectively.

Here are some factors to consider when deciding whether to do your own small business accounting:

-

The Accounting Knowledge

The first and most important factor to consider is your own accounting knowledge. If you are familiar with basic accounting principles and bookkeeping processes, you can probably manage your own accounting needs. However, if you lack experience or knowledge in accounting, you may want to consider taking a course or workshop to learn more about accounting concepts.

-

The software

If you decide to do your own accounting, you will need accounting software to keep track of your transactions and create financial reports. There are several accounting software options available in the market, and you can choose one that best suits your business’s needs.

-

The time like a essential data of management

Accounting can be time-consuming, and you will need to set aside enough time to manage your accounting tasks. You will need to regularly enter transactions, reconcile accounts, and generate financial reports. If you have limited time or prefer to focus on other aspects of your business, you may want to consider hiring an accountant or bookkeeper.

-

The Accuracy

Accuracy is essential in accounting, and it is important to ensure that your records are up-to-date and accurate. If you are not comfortable with bookkeeping or lack the attention to detail required for accounting, you may want to consider outsourcing your accounting to a professional.

-

The Tax Regulations

Tax regulations can be complicated, and it is important to ensure that your accounting records are compliant with tax laws. You may need to consult with a tax professional to ensure that you are following all necessary regulations and avoiding any potential penalties or fines.

So, small business owners can do their own accounting if they have the accounting knowledge, time, and software necessary to manage their finances accurately and efficiently. However, if you are not comfortable with accounting or lack the necessary resources, it may be beneficial to outsource your accounting to a professional. Ultimately, the decision to do your own accounting or outsource it depends on your personal preferences, resources, and business needs.