Having great products, star products, innovative marketing strategies and a well-stocked inventory is no longer enough to run a successful ecommerce business. The backbone of any successful ecommerce business is the power of effective ecommerce accounting.

An ecommerce accounting is essential for monitoring your financial health, managing your cash flow, ensuring supply capacity and guaranteeing compliance with tax regulations. Without it, you risk putting your business in dire straits, and falling into traps that inexperienced entrepreneurs often fall into.

For CEOs, CFOs, entrepreneurs, and freelancers alike, understanding the intricacies of ecommerce accounting is not just beneficial—it’s essential. This comprehensive guide will take you through the core principles of ecommerce accounting, equipping you with the necessary tools and insights to transform financial management from a burdensome task into a strategic advantage. Whether you’re just starting out or looking to refine your current practices, this article will help you harness the power of effective accounting to drive your business forward and secure long-term success.

1- The Importance of Ecommerce Accounting

Tracking Financial Health

Ecommerce accounting isn’t just about crunching numbers; it’s about gaining a deep, insightful understanding of your business’s financial health. By systematically recording all financial transactions, you can answer critical questions that are fundamental to your business’s success. Let’s delve into how comprehensive financial tracking can transform your business operations.

How Much Are You Spending?

One of the primary functions of ecommerce accounting is to monitor and record all expenses. This includes costs related to inventory, marketing, shipping, operational expenses, and more. Here’s how tracking expenses can benefit your business:

- Identify Cost-Saving Opportunities: By analyzing detailed expense reports, you can pinpoint areas where you might be overspending. For example, you might discover that switching to a different supplier or negotiating better rates can significantly reduce your costs.

- Avoid Unnecessary Expenditures: Regularly reviewing your spending helps you eliminate wasteful expenditures and reallocate resources to more productive areas. This ensures that every dollar spent contributes effectively to your business’s growth.

What Are Your Profits?

Understanding your profits is not just about knowing how much money you’re making, but also about understanding the sources and sustainability of these profits. Accurate accounting enables you to:

- Identify Your Most Profitable Products: Detailed profit analysis helps you see which products are driving your revenue and which ones might be dragging down your profitability. This allows you to focus on and expand your most profitable product lines.

- Analyze Profit Margins: By examining the profit margins of different products, services, or customer segments, you can make informed decisions about pricing, marketing, and sales strategies. This ensures you maintain healthy margins across your offerings.

Are You Within Your Anticipated Business Budget?

Adhering to your business budget is crucial for financial stability and strategic planning. Ecommerce accounting systems help you:

- Compare Actual Spending to Budgeted Amounts: Regular budget reviews allow you to track how closely your actual spending aligns with your planned budget. Discrepancies can signal the need for budget adjustments or more stringent cost controls.

- Forecast Future Expenses: Accurate tracking of current expenses helps in forecasting future costs. This foresight is essential for planning expansions, managing cash flow, and preparing for seasonal fluctuations.

Making Informed Decisions

With a clear, accurate view of your financial health, you are equipped to make informed, strategic decisions that drive growth. Here’s how:

- Plan for Growth: Use your financial data to plan for expansion. Whether you’re launching new products, entering new markets, or scaling your operations, detailed financial insights help you strategize effectively.

- Optimize Cash Flow: Effective cash flow management ensures you have sufficient funds to meet short-term obligations while also investing in long-term growth. Accurate accounting helps you monitor and optimize your cash flow.

- Evaluate Investment Opportunities: With a robust understanding of your financial health, you can accurately assess potential investment opportunities. This includes evaluating the expected return on investment and understanding the financial impact of these investments on your business.

Ensuring Tax Compliance

Tax compliance is non-negotiable. Understanding your sales tax obligations and ensuring timely payments is crucial to avoid penalties and maintain good standing with tax authorities. A solid ecommerce accounting system helps you stay on top of:

- Sales tax collection and remittance

- Payroll taxes

- Income tax obligations

Automated accounting tools like Finotor can simplify this process, ensuring accuracy and compliance without the headache.

2- Setting Up Your Ecommerce Accounting System

Choosing the right accounting software is the foundational step toward effective financial management for your ecommerce business. The right software can turn complex, time-consuming financial tasks into streamlined, automated processes, allowing you to focus on growth and strategy rather than administrative burdens. When selecting accounting software, it’s crucial to consider seamless integration with your ecommerce platform, robust reporting capabilities, and support for automation. Finotor, for example, stands out as an ideal choice for ecommerce businesses, offering a comprehensive suite of features designed to meet your specific needs.

One of the primary features to look for in accounting software is its ability to integrate seamlessly with your ecommerce platform. This integration ensures that all financial data—sales, expenses, and inventory—are automatically synchronized, reducing the need for manual data entry and minimizing the risk of errors. Automated data syncing and real-time updates are essential, as they ensure your financial records are always current and accurate. Finotor excels in this area, integrating effortlessly with popular ecommerce platforms like WooCommerce, providing accurate and up-to-date financial data at all times.

Robust reporting capabilities are another critical aspect of effective accounting software. Detailed and customizable reports help you understand profitability, cash flow, and expense management, providing insights into your business’s financial health. Customizable reports allow you to tailor financial statements to fit your specific needs, while advanced analytics tools help you delve deeper into your financial data, identifying trends and making data-driven decisions. Finotor offers a comprehensive suite of reporting tools, including customizable dashboards and advanced analytics, enabling you to gain deeper insights into your financial performance.

Automation features are game-changers in financial management, reducing manual workload and ensuring accuracy. Automated transaction recording, invoicing, and payment processing help ensure timely billing and collection, improving cash flow management. Additionally, automation of tax calculations and filings ensures compliance with local regulations without the hassle. Finotor excels in automation, offering features such as automated transaction recording, real-time financial insights, and compliance monitoring. This reduces the burden on your finance team and ensures that your financial data is always accurate and up-to-date.

Your accounting software should also be able to grow with your business, offering scalability and flexibility to handle increasing transaction volumes and additional features as needed. Scalable solutions can accommodate growth, from handling more transactions to integrating with additional sales channels. Flexible features allow you to add or customize functionalities based on your evolving needs. Finotor is designed to scale with your business, offering flexible plans and features that can grow as your business expands, adapting to your changing needs whether you’re adding new product lines or entering new markets.

Finally, a user-friendly interface is crucial to ensure that your team can easily navigate and use the software, reducing the learning curve and increasing productivity. Ease of use and comprehensive support and training resources are essential for getting the most out of your accounting software. Finotor boasts an intuitive interface that simplifies complex accounting tasks, along with comprehensive support and training resources to ensure your team can effectively use the software from day one.

Integrate with Your Ecommerce Platform

Integrating your accounting software with your ecommerce platform (like WooCommerce) ensures that all your sales, expenses, and inventory data are automatically synced. This reduces manual entry errors and provides a comprehensive view of your financial activities in real-time.

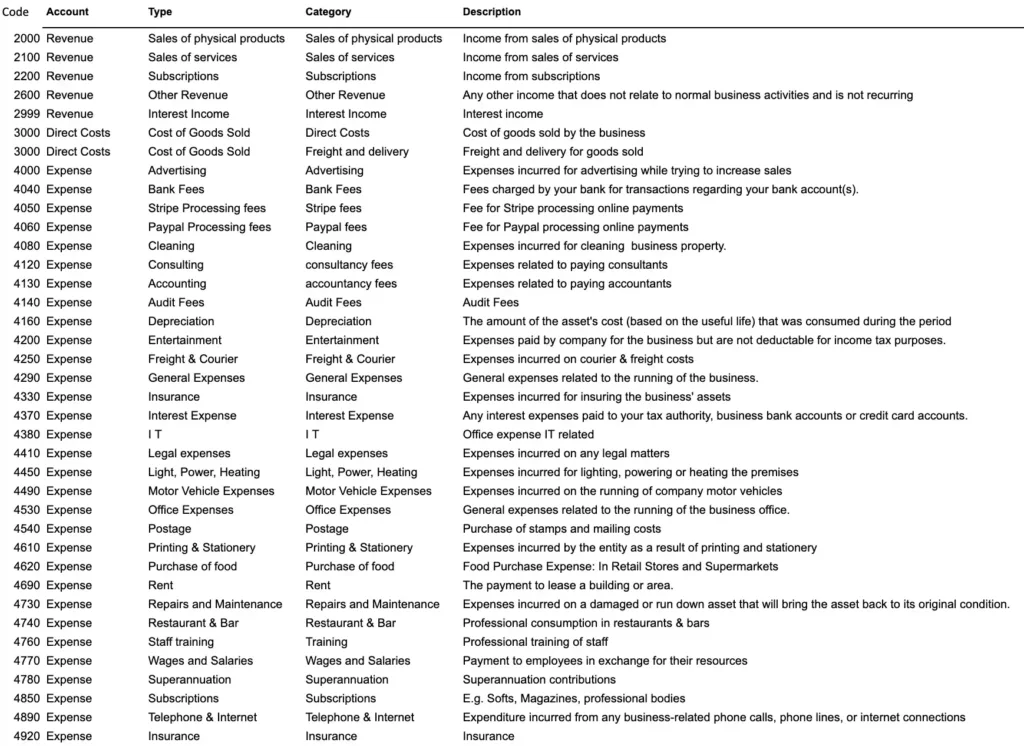

Set Up Your Chart of Accounts

A well-organized chart of accounts is essential for categorizing financial transactions. This includes categories such as:

- Sales

- Expenses

- Assets

- Liabilities

- Equity

Proper categorization helps you track where your money is coming from and where it’s going, making it easier to generate accurate financial reports.

3- Automating Financial Processes

Automated Transaction Recording

Invoice and Payment Automation

Manually managing invoices and payments can be cumbersome and error-prone. Automating these tasks using your accounting software streamlines billing and payment collection, improves cash flow, and reduces the risk of late payments. Here’s how you can effectively automate invoicing and payment processing.

Benefits of Automation

Automating invoicing and payment processing ensures timely billing and payment collection, which is crucial for maintaining a healthy cash flow. It eliminates the delays often associated with manual invoicing and reduces the chances of errors. Automation speeds up the entire billing process, allowing invoices to be generated and sent out promptly, thereby accelerating payment receipt. This improvement in cash flow can significantly benefit your business by providing more liquidity and financial stability.

Automated Invoicing and Payment Processing Features

Your accounting software can automatically generate invoices based on predefined schedules or upon completion of sales. This ensures that all sales are promptly invoiced without the need for manual intervention. The software can also handle recurring billing for regular customers, sending invoices at specified intervals. This feature is particularly useful for subscription-based services or long-term contracts.

Payment processing integration is another critical feature. Your accounting software can integrate with various payment gateways, allowing customers to pay through multiple methods, including credit cards, ACH transfers, and digital wallets. This integration not only facilitates seamless payment collection but also ensures that payments are processed quickly and securely.

Automated payment reminders and notifications help in reducing the instances of late payments. The software can automatically send reminders to customers for upcoming or overdue payments. Additionally, you can receive notifications about received payments and outstanding invoices, keeping you informed about your financial status in real-time.

Implementing Automation

To implement automation, start by configuring your accounting software to generate invoices automatically. Set up templates for different types of transactions to ensure consistency and professionalism in your billing. Define the schedules for invoice generation, whether it’s upon the completion of a sale or at regular intervals for recurring charges.

Integrate your accounting software with your preferred payment gateways to streamline payment processing. Ensure that your system can accept various payment methods to cater to different customer preferences. Set up automated payment reminders to go out at strategic intervals before and after the payment due date.

Finally, take advantage of real-time tracking and reporting features. Your software should allow you to monitor the status of each invoice and payment. Use the reporting tools to generate detailed insights into your invoicing and payment activities. These reports can help you identify trends, manage cash flow better, and plan for the future.

Automating invoicing and payment processing with your accounting software is a strategic move that enhances efficiency, accuracy, and cash flow management. By eliminating manual processes, you reduce errors, ensure timely billing, and accelerate payment collection. This automation not only improves your financial operations but also allows your team to focus on more critical business activities, driving overall productivity and growth

Inventory Management

Accurate inventory tracking is essential in e-commerce, where maintaining the right balance of stock is critical for meeting customer demands and optimizing financial resources. Automated inventory management systems offer a robust solution by updating inventory levels in real-time as sales occur.

This immediate adjustment helps prevent stockouts, ensuring that popular products are always available for purchase, thereby enhancing customer satisfaction. Simultaneously, it mitigates the risk of overstocking, which can tie up valuable working capital in unsold inventory. By streamlining the inventory process, these systems reduce manual errors and provide a clear, up-to-date view of stock levels.

This visibility allows businesses to make informed purchasing decisions, plan better for future demand, and improve overall operational efficiency. Ultimately, automated inventory management not only supports a seamless customer experience but also helps in maintaining a healthy cash flow and optimizing the allocation of resources.

4- Key Financial Tasks to Automate

Accounts Payable and Receivable

Implementing an automated expense management system is a transformative step towards achieving efficient and accurate financial operations. By automating the tracking and categorization of expenses in real-time, businesses can streamline their financial processes, reduce errors, and ensure better financial oversight.

One of the key features of such a system is the ability to capture receipts through mobile apps. Employees can easily photograph and upload receipts directly from their smartphones, eliminating the need for manual entry and paper trails. These receipts are then automatically integrated into the accounting software, where they are categorized and logged in real-time. This seamless integration not only saves time but also ensures that all expenses are accounted for promptly and accurately.

The real-time tracking capability of automated expense management systems provides businesses with up-to-date insights into their spending patterns. This allows for more informed budgeting and financial planning, as managers can see exactly where funds are being allocated and identify any areas of overspending. The system’s ability to categorize expenses automatically ensures that all costs are properly recorded under the correct accounts, facilitating more precise financial reporting and analysis.

Furthermore, an automated expense management system can enforce compliance with company policies and regulatory requirements. By setting predefined rules and limits within the system, businesses can ensure that all expenses adhere to established guidelines, reducing the risk of fraud and unauthorized spending. This also simplifies the auditing process, as all expense data is systematically organized and easily accessible.

Overall, automating expense management enhances efficiency, accuracy, and transparency in financial operations. It reduces the administrative burden on staff, minimizes the risk of errors and fraud, and provides valuable insights for better financial decision-making. By capturing and integrating expenses in real-time, businesses can maintain a clear and accurate view of their financial health, enabling them to operate more effectively and strategically.

Financial Reporting

Generating financial reports automatically is essential for gaining comprehensive insights into your business’s performance. Automated financial reporting systems produce regular reports such as profit and loss statements, balance sheets, and cash flow statements, providing a clear and accurate picture of your financial health. These reports are crucial for strategic decision-making, allowing you to make informed choices based on real-time data.

Automated financial reporting systems gather data from various sources within your accounting software, ensuring that all financial activities are accurately recorded and reflected in the reports. By eliminating manual data entry, these systems reduce the risk of errors and provide consistent, reliable financial information.

Profit and loss statements, generated automatically, detail your revenues, costs, and expenses over a specific period. These statements help you understand your net income and identify trends in profitability. With automated systems, you can customize the frequency of these reports to suit your needs, whether it’s monthly, quarterly, or annually.

Balance sheets provide a snapshot of your company’s financial position at a given point in time, listing assets, liabilities, and equity. Automated balance sheet generation ensures that you have up-to-date information on what your business owns and owes, enabling better management of resources and liabilities.

Cash flow statements track the inflows and outflows of cash within your business. These statements are crucial for understanding how well your company manages its cash to fund operations, pay debts, and invest in growth. Automated cash flow reporting allows you to monitor liquidity in real-time, ensuring you can meet financial obligations and seize investment opportunities as they arise.

Regularly generating these reports through automation not only saves time but also ensures that you have timely and accurate data for strategic planning. Automated financial reporting systems can also provide customized reports tailored to specific aspects of your business, such as departmental performance or project profitability, offering deeper insights into your operations.

In summary, automating financial reporting enhances the accuracy, consistency, and timeliness of your financial data. This comprehensive approach to financial management supports informed decision-making, strategic planning, and ultimately, the long-term success of your business. By leveraging automated systems, you can maintain a clear, real-time view of your financial health, ensuring you are always equipped with the information needed to drive your business forward.

Common Pitfalls and How to Avoid Them

Ignoring Regular Reconciliations

Regular reconciliations are crucial to ensure your books match your bank statements. Ignoring this important task can lead to discrepancies that are difficult to resolve later. When financial records are not regularly reconciled, errors and inconsistencies can accumulate over time, making it challenging to identify and correct them. This can result in inaccurate financial reporting, potential compliance issues, and difficulties in managing cash flow effectively.

Solution:

- Schedule Monthly Reconciliations: Set a fixed date each month to perform bank reconciliations. This consistency helps to catch and correct errors promptly.

- Automate Where Possible: Utilize accounting software that can automatically match transactions with bank statements. This reduces manual effort and minimizes the risk of human error.

- Designate a Responsible Person: Assign the task of reconciliation to a specific individual or team. This ensures accountability and consistency in the process.

- Review and Investigate Discrepancies Immediately: When discrepancies are identified, investigate and resolve them as soon as possible to prevent them from compounding over time.

- Maintain Clear Documentation: Keep detailed records of reconciliations and any corrections made. This provides a clear audit trail and helps in identifying recurring issues.

By implementing these solutions, businesses can ensure their financial records remain accurate, up-to-date, and reflective of their actual financial position. Regular reconciliations are an essential practice for maintaining financial integrity and operational efficiency.

Poor Cash Flow Management

Poor cash flow management can spell disaster for even the most profitable businesses, leading to liquidity issues and financial instability. To avoid such pitfalls, it’s crucial to monitor cash flow regularly. Tools like Finotor can be invaluable in this regard, as they automate payment reminders and effectively manage receivables. By leveraging Finotor’s capabilities, businesses can ensure timely payments, maintain a steady cash flow, and focus on growth and operational efficiency without the constant worry of financial shortfalls. Regular monitoring coupled with automation creates a proactive approach to cash flow management, safeguarding the business’s financial health.

Case Studies: Successful Ecommerce Accounting Implementations

Case Study 1: The Fashion Boutique

A fashion boutique struggled with manual accounting processes that consumed hours each week. After implementing Finotor, they automated their invoicing and inventory management, resulting in a 40% time savings and a significant reduction in stockouts.

Case Study 2: The Tech Gadgets Store

A tech gadgets store faced compliance issues due to incorrect tax calculations. By integrating Finotor, they automated their tax filings and improved accuracy, avoiding penalties and gaining peace of mind.

Conclusion: Transforming Accounting from a Chore to an Advantage

Accounting doesn’t have to be the cancer of ecommerce. With the right tools and strategies, you can transform your accounting processes from a dreaded chore into a powerful strategic advantage. Finotor, with its advanced automation features and insightful analytics, provides the perfect solution to streamline your financial management. By automating tedious tasks like transaction recording, invoicing, and tax compliance, Finotor ensures that your financial data is always accurate and up-to-date, freeing you to focus on what truly matters—growing your business.

Implementing an efficient accounting system like Finotor not only saves time and reduces the risk of errors but also provides real-time financial insights that are crucial for informed decision-making. You gain a clear, comprehensive view of your business’s financial health, enabling you to make strategic decisions with confidence. Whether it’s identifying cost-saving opportunities, optimizing your pricing strategies, or planning for future growth, the data and insights provided by Finotor empower you to steer your business in the right direction.

Moreover, the automation capabilities of Finotor ensure that your business remains compliant with tax regulations and ready for audits, reducing the stress and hassle associated with financial management. By maintaining accurate and detailed financial records, you can easily meet regulatory requirements and avoid penalties, ensuring the long-term stability and success of your ecommerce venture.

In today’s fast-paced ecommerce environment, staying competitive requires more than just great products and marketing strategies. Efficient and accurate financial management is the backbone that supports sustainable growth and success. By transforming your accounting from a laborious task into a strategic asset with Finotor, you position your business to thrive.

Embrace the power of efficient accounting today and watch your ecommerce venture not just survive but flourish. With Finotor, turn your financial management into a driving force for growth, allowing you to focus on innovation, customer satisfaction, and expanding your market presence. Accounting doesn’t have to be a burden; with the right tools, it can be the catalyst that propels your business to new heights.

FAQs

What is the difference between accounting for ecommerce and traditional retail?

Ecommerce accounting often involves managing online payment processors, handling various sales tax jurisdictions, and dealing with digital products. Traditional retail accounting typically deals with physical store transactions and local tax regulations.

How can I automate my ecommerce accounting?

You can automate ecommerce accounting by using integrated accounting software that syncs with your ecommerce platform, automates transaction recording, and generates financial reports.

What are common accounting mistakes in ecommerce?

Common mistakes include failing to reconcile accounts regularly, neglecting to track inventory accurately, and not keeping detailed records of expenses and revenues.

How often should I review my financial statements?

It’s advisable to review your financial statements monthly. Regular reviews help you monitor your business’s performance and make timely adjustments.

What should I look for in ecommerce accounting software?

Look for features like inventory management, integration with your ecommerce platform, automated financial reporting, and tax compliance capabilities.

Can I handle ecommerce accounting myself, or do I need a professional?

While some business owners manage their own accounting, hiring a professional can save time and ensure accuracy, especially as your business grows.

By implementing these principles and practices, you can transform your ecommerce accounting from a burdensome task into a strategic advantage, driving your business towards long-term success.