Contents

When a business owner contacts us for advice on using Finotor for an investment project, we discuss one of the fundamental concepts: Weighted Average Cost of Capital (WACC).

Many people know how to use Finotor with a low learning curve and are very satisfied with it, but this must be complemented by knowledge of this formula and, above all, what is it used for?

The WACC (Weighted Average Cost of Capital) is a financial metric that tries to measure the overall cost of a company’s financing by considering the relative weight between debt and equity. Minima return is the figure it represents a company needs to make, in order satisfy its investors as well as creditors.

Which Target Market?The Weighted Average Cost of Capital (WACC) is a root financial measurement that can be applied to a wide range of industries, particularly those with a mix of equity and debt financing. It is especially relevant in industries characterized by relatively high financial leverage, long-term investments, and capital intensive operations.

🔹 Industries Driven By WACC

1️⃣ Finance & Investment Banking

📌 Used for company valuations, M&A transactions, leveraged buyouts (LBOs).

📌 Banks and investment firms rely on WACC in structuring financing deals.

2️⃣ Manufacturing & Industrial Goods

📌 Capital-intensive sector with heavy investments in machinery, equipment, infrastructure.

📌 Companies need to lower their WACC by balancing equity and debt financing,.

3️⃣ Energy & Utilities

📌 Heavy reliance on long-term capital investments in infrastructure (e.g. power plants, pipelines).

📌 Large corporates, often funded via a blend of corporate bonds and private equity.

4️⃣ Real Estate & Construction

📌 Developers and REITs (Real Estate Investment Trusts) use WACC to evaluate whether large-scale real estate projects are profitable.

📌 Real estate must finance its operations with debt, making WACC an essential consideration.

5️⃣ Technology & Software Companies

📌 While software firms tend to have lower debt, young tech companies rely on WACC to discover the cost of raising venture capital compared with an IPO.

📌 For decisions on research and development investment.

6️⃣ Telecommunications

📌 This requires a lot of infrastructure investment (fiber optics, and 5G networks).

📌 As a project decision-making device in controlling the cost of debt by using WACC, companies in certain industries manage WACC in order to make an appropriate capital structure for long-term profitability.

7️⃣ Pharmaceuticals & Healthcare

📌 WACC is used by pharmaceutical companies to evaluate drug development projects (such as, which pharmaceuticals are produced next).

📌 Hospitals and biotech firms have financing strategies for expansion plans and product launches as a way to grow their business given the industry and nature of what they do/provide that they engage in, invent new products.

8️⃣ Transportation & Logistics

📌 Airlines, shipping companies and logistics companies also finance large asset purchases (such as airplanes, fleets) by using a mixture of equity and debt.

📌 With WACC we can determine what the cheapest way probably is to finance a new project.

9️⃣ Consumer Goods & Retail

📌 Cosmetic companies and chain stores of supermarkets use WACC to analyze different expansion strategies such as the opening of new stores.

📌 WACC theoretically adjusts pricing models Profit margins.

🔟 Mining, Oil & Gas

📌 For this sector long-term capital investment is very important, so is commodity price fluctuation.

📌 And they will adjust things like their capital structure in order to produce a WACC that is competitive.

What’s the point of WACC? (Weighted Average Cost Of Capital Formular)

W ACC(short for):Weighted Avg.Cost of Capital is a key financial indicator that measures the cost of funding for an enterprise in general, taking into consideration both how much debt and what fraction equity is used.Advantaged financing rates means lower hurdle rates.Wagranteeing a low WACC is the required minimum return a company must provide to meet the needs of its various investors and creditors.

🔹 Major Uses of WACC

1️⃣ These include investment assessment and also capital budgeting.

📌 Used in the Discounted Cash Flow (DCF) method as a discount rate to judge if the total profits from an investment project or business are sufficient for it to be worthwhile

📌 You can see from this that if the anticipated yield on a project exceeds WACC, then the project is creating value.

📌 Conversely, in cases where anticipated yield is less than WACC, the project destroys value and should not be undertaken.

2️⃣ Business valuation

📌 In company valuation models, especially discounted cash flow models when determining the intrinsic value of a business.Using WACC to discount coming cash flows and employing it in company valuation models.

📌 When the WACC is low a company will be more able to finance its operations with lower-cost capital, thus pushing up its market value.

3️⃣ Optimized Capital Structure

📌 Does it help you find the best balance between debt and equity to minimize capital costs?

📌 Too much debt leads to an increase in financial risk and WACC, while too much equity brings high costs because of dividend expectations from shareholders.

4️⃣ Contrast of WACC with ROIC (Return on Invested Capital)

📌 Comparing ROIC (Return on Invested Capital) with WACC:

If ROIC > WACC → A company creates benefts for investors.

If ROIC 8 percent, it creates value and should be accepted.

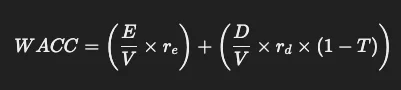

🔹 Weighted Average Cost of Capital (WACC) Formula

The Weighted Average Cost of Capital (WACC) represents a firm’s overall cost of capital, taking into account the different proportions of debt and equity in its capital structure. The calculation of WACC is based on the formula below which makes use of the COST OF EQUITY and COST OF DEBT:

WACC = (E/V x Re) + [(D/V x Rd) x (1 – T)]

Where:

- EE = Market value of equity

- DD = Market value of debt

- VV = Total market value of the firm’s financing (V=E+DV = E + D)

- rer_e = Cost of equity (e.g., calculated using the Capital Asset Pricing Model (CAPM))

- rdr_d = Cost of debt (typically the yield on corporate bonds)

- TT = Corporate tax rate

Key Considerations:

-

Equity Component (rer_e):

Often estimated using the CAPM:re=rf+β(rm−rf)r_e = r_f + \beta (r_m – r_f)

- rfr_f = Risk-free rate (e.g., government bond yield)

- β\beta = Equity beta (measure of stock volatility)

- rmr_m = Expected market return

-

Debt Component (rdr_d):

The cost of debt is adjusted for tax savings because interest payments are tax-deductible. -

Weighting Factor:

The proportion of equity and debt in the capital structure is used to weight their respective costs.

Example Calculation:

- Equity Market Value (EE) = $50M

- Debt Market Value (DD) = $30M

- Cost of Equity (rer_e) = 10%

- Cost of Debt (rdr_d) = 5%

- Corporate Tax Rate (TT) = 25%

Step 1: Calculate total firm value

V=E+D=50M+30M=80MV = E + D = 50M + 30M = 80M

Step 2: Calculate weighted costs

(5080×10%)+(3080×5%×(1−0.25))\left( \frac{50}{80} \times 10\% \right) + \left( \frac{30}{80} \times 5\% \times (1 – 0.25) \right)

Step 3: Compute WACC

(0.625×10%)+(0.375×5%×0.75)(0.625 \times 10\%) + (0.375 \times 5\% \times 0.75) 6.25%+1.41%=7.66%6.25\% + 1.41\% = 7.66\%

Final Answer:

WACC=7.66%WACC = 7.66\%

🚀 Key Takeaway: WACC helps businesses assess the minimum return required to satisfy both debt and equity investors. A lower WACC means cheaper financing, improving business profitability.

You can read to: 10 most important Finance Equations we Should Know

🔹 Conclusion

WACC is an important financial metric for:

✅ Assessing the profitability of investments

✅ Optimizing a company’s financial structure

✅ Maximizing value for shareholders

If the WACC is lower, the company is able to finance at a lower cost.Hence, this will make very big profits.

📊 A lower WACC means the company can finance itself at a lower cost, enhancing its competitiveness and profitability. 🚀