Calculate an amount including or excluding VAT with a VAT rate

Online VAT calculator for goods and services

Before using our VAT calculator: Understanding VAT (Value Added Tax)

To use our vat calculator, we have to understand that Value Added Tax on goods and services in European Union, commonly known as VAT, is a fundamental aspect of modern taxation that affects nearly everyone, whether they realize it or not. As a consumption tax applied to most goods and services, VAT plays a important role in the economies of many countries. It is added at each stage of production or distribution, with the final burden resting on the consumer.

Whether you’re a business owner calculating prices for your products or a consumer trying to understand how much you’re paying in taxes, understanding VAT is essential. Our VAT calculator can do this job. This guide will walk you through the basics of what VAT is, who uses it, and how to calculate it in various scenarios. By the end, you’ll be equipped with the knowledge to calculate VAT manually with our VAT Calculatror or even automate the process using tools like Excel.

What is a VAT Rate?

Definition of VAT

VAT is a type of consumption tax that is levied on the value added to goods and services at each stage of production or distribution. Essentially, whenever a product is sold or a service is provided, VAT is added to the price, to the gross amount. You can see that with the VAT calculator.

This tax is ultimately borne by the final consumer, making it a common feature in retail transactions across the globe. Unlike sales tax, which is only applied at the point of sale to the consumer, VAT is charged at each step of the supply chain, from manufacturing to the final sale.

To use a VAT calculator you need to determine the correct rate to apply to the net amount to obtain the gross amount on goods and services.

Purpose of VAT

The primary purpose of VAT is to generate revenue for governments. By taxing the added value at each stage of production, VAT ensures that the government collects tax revenue more consistently and broadly across the economy. This revenue is critical for funding public services, infrastructure projects, and other government activities.

VAT on goods and services, determined by a VAT Calculator, is often favored by governments because it is less visible to consumers than a direct tax, like income tax, yet it provides a steady and reliable source of income.

Variations in VAT Rates

Value Added Tax, can vary significantly from one country to another, and even within a country, depending on the type of goods and services, that’s why you hase to use our vat calculator. Some countries have a standard VAT rate that applies broadly, while others have multiple rates, including reduced rates for essential goods like food and medicine, and higher rates for luxury items.

For example, in the European Union, the standard Value Added Tax rates generally range between 17% and 27%, but some countries offer reduced rates on certain items, and others may even apply a zero rate on specific goods like exports. Understanding the specific VAT rate applicable in your region and to the goods and services in question is important for accurate pricing and compliance.

In the Republic of Ireland, for example, the standard rate of VAT is 23%. In Ireland, Value-Added Tax on certain goods and services is subject to a reduced rate of VAT, such as the reduced rate of 13.5% that applies to certain goods and services (fuel, building services, etc.) and another one for such as children’s car seats. So you have to use a VAT calculator using the gross amount. The reduced rate applies to a selection of goods and services including health products, fuel and children’s car seats.

To find out more about Value-Added Tax in Ireland, many Irish companies use our VAT Calculator

Who Uses VAT? Who needs the VAT Calculator?

-

Businesses – A headache

Businesses are key players in the VAT system. They are responsible for charging VAT on the goods and services they sell to customers. This VAT is added to the sale price, and the business collects it on behalf of the government. However, businesses also pay VAT on the goods and services they purchase from other businesses. They are obvious users of the VAT Calculator

To avoid double taxation, they can deduct the VAT they have paid on their purchases (known as input VAT) from the VAT they collect on their sales (known as output VAT). The difference between the two amounts is what the business must remit to the government. This mechanism, known as VAT credit, ensures that VAT is effectively only applied to the final value added at each stage of production.

-

Consumers – The main user

Consumers ultimately bear the cost of VAT. When they purchase goods and services, the price they pay includes VAT, which is often not itemized separately in retail transactions. This means that the tax is embedded in the price of nearly everything they buy. Unlike businesses, consumers cannot claim back the VAT they have paid, making them the final taxpayers in the VAT chain. This indirect nature of VAT makes it less noticeable to consumers, but it still affects the overall cost of living and purchasing power.

-

Governments – A particularity

Governments are responsible for setting Value Added Tax rates and collecting the tax. The revenue generated from VAT is a major source of income for many governments around the world. It helps fund public services such as healthcare, education, and infrastructure. Governments determine the VAT rate applicable to different types of goods and services, which can vary widely depending on national policies and economic conditions. They are obvious users of the VAT Calculator. They are also obvious users of the VAT Calculator.

They also enforce compliance through regular audits and checks to ensure that businesses are correctly collecting and remitting VAT. By adjusting Value Added Tax rates, governments can influence consumer behavior, manage inflation, and respond to economic changes, making VAT an important tool in fiscal policy.

How to Calculate a Price Including VAT

-

Formula for Calculating Price Including VAT on the goods and services

To calculate the price of a product or service including VAT, you can use the following formula with the net amount:

This formula adds the VAT to the initial price by multiplying the price excluding VAT by one plus the VAT rate (expressed as a decimal). The result is the total price a consumer will pay, including the VAT.

You can manually calculate the VAT or use directly our VAT calculator from the net amount.

-

Example Calculation

Let’s walk through a practical example to illustrate how to calculate the price including VAT, from the net amount to the gross amount.

Scenario: You have goods and services that costs $ or €100 before VAT (net amount), and the VAT rate is 20%.

Step 1: Identify the Price Excluding VAT

- Price Excluding VAT: $ or €100 net amount

Step 2: Identify the VAT Rate

- VAT Rate: 20%

Step 3: Apply the Formula

- First, convert the VAT rate into a decimal: 20% = 0.20

- Next, add 1 to the VAT rate: 1+0.20=1.201 + 0.20 = 1.20

- Finally, multiply the Price Excluding VAT by this factor: Price Including VAT=€100×1.20=€120\text{Price Including VAT} = €100 \times 1.20 = $ or €120

Result: The price including VAT is $ or €120.

This means that when a customer purchases this product, they will pay a total of $ or €120, which includes $ or €20 as the VAT amount. With VAT calculator it will easier.

How to Calculate the Initial Price Excluding VAT

-

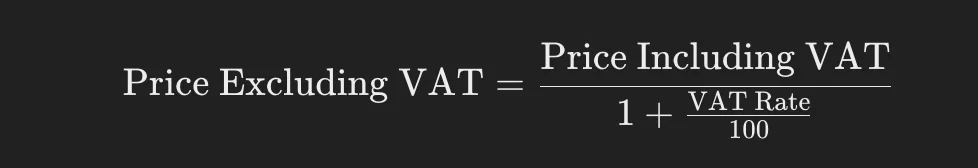

Formula for Calculating Price Excluding VAT

To calculate the initial price of goods and services before VAT is added, or gross amount, you can use the following formula:

Price Excluding VAT = Price Excluding VAT/(1+VAT Rate/100)

It’s the same thing to remove VAT. This formula allows you to determine the original price of an item before the VAT was applied by dividing the total price (including VAT) by one plus the VAT rate (expressed as a decimal).

-

Example Calculation without VAT calculator

Let’s go through an example to illustrate how to calculate the price excluding VAT or the gross amount without online VAT calculator

So let’s remove VAT.

Scenario: You purchased an item for €120, which includes a VAT rate of 20%. You want to find out the original price of the item net amount was added, to remove VAT.

Step 1: Identify the Price Including VAT

- Price Including VAT: €120

Step 2: Identify the VAT Rate

- VAT Rate: 20%

Step 3: Apply the Formula

- First, convert the VAT rate into a decimal: 20% = 0.20

- Next, add 1 to the VAT rate: 1+0.20=1.201 + 0.20 = 1.20

- Finally, divide the Price Including VAT by this factor: Price Excluding VAT=€1201.20=€100\text{Price Excluding VAT} = \frac{€120}{1.20} = €100

Result: The price excluding VAT or remove VAT is €100.

This means that the original price of the item before VAT was added was €100. The additional €20 represents the VAT amount that was added to reach the final price of €120.

How to Calculate VAT Manually

-

Step 1: Identify the VAT Rate

The first step in calculating VAT manually so without VAT calculator, is to identify the applicable VAT rate for the gross amount about the goods and services. VAT rates can vary depending on the country, and sometimes even within the country, depending on the type of goods and services.

Important : Before you get carried away with your calculations, check and confirm that the rate you are thinking of using is the right one.

Step 2: Determine the Price Excluding VAT

As with using a VAT calculator, once you know the VAT rate, the next step is to determine the price of the product or service before VAT (net amount) is added—this is known as the price excluding VAT. If you are the seller, this is typically the base price you charge for the item before applying any taxes. If you only have the final price (including VAT), you can calculate the price excluding VAT by using the formula covered earlier.

Step 3: Apply the VAT Rate

With the base price (excluding VAT) and the VAT rate in hand, you can now calculate the VAT amount. To do this, multiply the price excluding VAT by the VAT rate (expressed as a decimal). The formula is straightforward:

Price Including VAT = Price Excluding VAT×(1+VAT Rate/100)

This will give you the amount of VAT that needs to be added to the base price. Use our VAT calculator above to check the results of your calculations.

Step 4: Calculate the Price Including VAT

Finally, to find the total price including VAT, the gross amount, you simply add the VAT amount to the original price excluding VAT. Use the formula above.This final figure is what the customer will pay for the product or service.

Example Calculation

Let’s go through an example to clarify the manual calculation of VAT.

Scenario: You are selling a product with a base price of €200, and the applicable VAT rate is 15%. You want to calculate the final price including VAT.

Step 1: Identify the VAT Rate

- VAT Rate: 15%

Step 2: Determine the Price Excluding VAT

- Price Excluding VAT: €200

Step 3: Apply the VAT Rate

- Convert the VAT rate to a decimal: 15% = 0.15

- Calculate the VAT amount: VAT Amount=€200×0.15= €30\text{VAT Amount} = €200 \times 0.15 = €30

Step 4: Calculate the Price Including VAT

- Add the VAT amount to the base price: Price Including VAT=€200+€30=€230\text{Price Including VAT} = €200 + €30 = €230

Result: The final price,gross amount including VAT, is €230.

This example shows how easy it can be to calculate VAT manually, allowing you to understand how much tax is being added to the base price and what the final cost will be. Use again our VAT calculator above to compare results.

How to Calculate VAT in Excel

-

Basic Excel Formula for VAT

Calculating VAT in Excel is a straightforward process that can save you time and reduce the risk of manual errors. You can easily set up formulas to calculate the price including VAT based on a given price excluding VAT and a specified VAT rate. Here’s a basic formula you can use:

- Formula:

=A1*(1+B1/100)

In this formula:

A1represents the cell containing the price excluding VAT.B1represents the cell containing the VAT rate as a percentage.

Example: If the price excluding VAT is in cell

A1and the VAT rate is 20% (in cellB1), the formula=A1*(1+B1/100)will calculate the price including VAT. IfA1contains €100 andB1contains 20, the result will be €120.This formula multiplies the base price by

1 + VAT rate(converted to a decimal) to give the final price including VAT.Reverse Calculation for Price Excluding VAT

If you have the price including VAT and need to calculate the price excluding VAT, you can use a different formula:

- Formula:

=A1/(1+B1/100)

In this formula:

A1represents the cell containing the price including VAT.B1represents the cell containing the VAT rate as a percentage.

Example: If the price including VAT is in cell

A1and the VAT rate is 20% (in cellB1), the formula=A1/(1+B1/100)will calculate the price excluding VAT. IfA1contains €120 andB1contains 20, the result will be €100.This formula divides the total price by

1 + VAT rate(converted to a decimal) to find the original price before VAT, net amount was added.Additional Tips

- Cell References: When working with large datasets, use cell references to link your VAT calculations across different cells and sheets. This way, you can easily update rates or prices without manually adjusting every formula.

- Formula Drag-Down: Excel allows you to apply the same formula to multiple rows by dragging the fill handle (a small square at the bottom-right corner of the selected cell) down across the rows. This is particularly useful for calculating VAT on multiple products or services simultaneously.

- Named Ranges: For more complex spreadsheets, consider using named ranges for your VAT rates and prices. This can make your formulas easier to read and manage, especially if you are working with multiple VAT rates or price lists.

By leveraging Excel’s powerful formula capabilities, you can automate your VAT calculations, making your financial management more efficient and accurate.

- Formula:

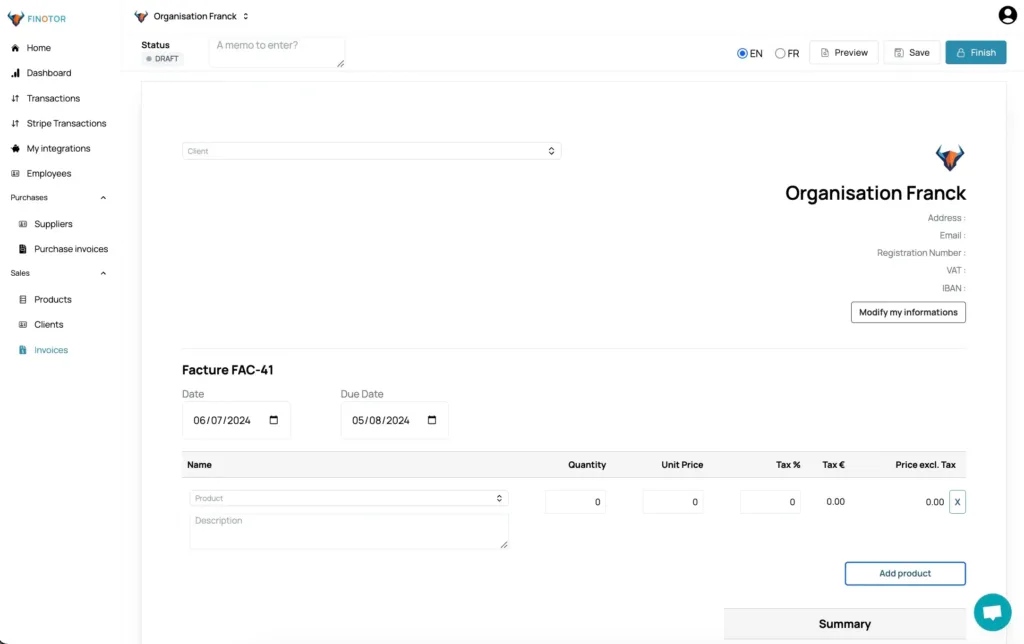

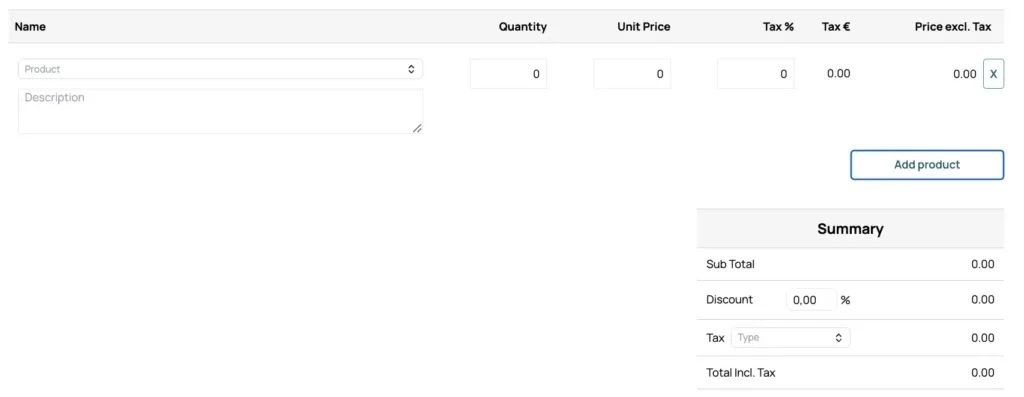

How to calculate VAT with Finotor

It’s extremely simple!

Finotor allows you to automate your accounting, connect your banks,… (see all the features)

There’s no need to use our VAT calculator, as Finotor does all the calculations automatically.

Step 1 – Opt for a Finotor account, even a free one: Open my Finotor account

Step 2 – Go to the ”Invoice” menu and click on the “Create an invoice” button

Step 3 – Click on “Add a product” and play with the different fields

Conclusion about VAT Calculator

Summary of Key Points

In this guide, we’ve explored the essentials of Value Added Tax (VAT), a vital component of the global taxation system. We started by defining what VAT is and how it functions as a consumption tax applied to goods and services at various stages of production. We discussed who uses VAT—primarily businesses, consumers, and governments—and the different roles each plays in the VAT system.

We also walked through the process of calculating VAT, whether you’re determining the price including VAT, extracting the price excluding VAT, or calculating VAT manually with clear, step-by-step instructions. Additionally, we provided guidance on how to use Excel to automate these calculations, offering formulas and tips to streamline your financial processes.

Importance of Understanding VAT to use VAT calculator

Understanding VAT is a determining factor for both businesses and consumers and to use VAT calculator. For businesses, accurate VAT calculation and compliance are essential for financial health and legal adherence. Properly managing VAT ensures that businesses can accurately price their products, remit the correct amount of tax to the government, and avoid costly penalties.

For consumers, awareness of VAT and VAT calculator help in understanding the final cost of products and services and in recognizing how much of their spending goes toward taxes. This knowledge can also empower consumers to make more informed purchasing decisions.

Ultimately, Before use the VAT Calculator, you have to understand that VAT is a tax that touches nearly every financial transaction, making it important for everyone to understand its impact on prices, business operations, and economic systems as a whole. By mastering the basics of VAT, you can better navigate the financial aspects of your business or personal life, ensuring that you are well-prepared to handle any VAT-related challenges that come your way.