Contents

Do you want to get paid faster and with less hassle, less stress? Or maybe you need to make billing more fun? The answer may be simpler than you think: Use the Invoice Smarter. After that, smile and get paid! Smart billing is the new way to get the money you’re owed, and it all starts with a smile.

It’s true that when you put it that way, it sounds relatively easy. But it’s also about relationships and mindset. What relationship do you want with your customers?

You can have a very professional and corporate approach and attitude and this will be reflected in the speech and the content of the exchanges. This will be effective, but is it pleasant for your customers? If you took a step aside and tried to do things differently.

Make your business and accounting relationship a friendly and caring one. It will be pleasant for you, but more importantly for your client. The customer has to pay a bill, so you might as well have a little fun with it.

Make smiling a payment strategy with the Invoice Smarter

Sending an invoice can often be a tedious process. However, if you make it a habit to add a friendly message to your invoice, you’ll be surprised at how much faster you’ll get paid. A simple smile can go a long way and show your customers that you appreciate their business. This will make them more likely to give you a positive review or even recommend you to other customers.

Not only does smiling reduce the amount of effort it takes to get paid, but it also shows that you care about your clients and the services you provide. This creates an environment of trust and encourages an open relationship that can only benefit you and your business.

Get paid faster, smarter and happier.

It’s easy to get paid faster and smarter when you use the “Invoice Smarter” approach. This method aims to streamline the process of sending invoices and getting paid. From automated invoicing to payment reminders, there are many tools to make the process easier and more efficient.

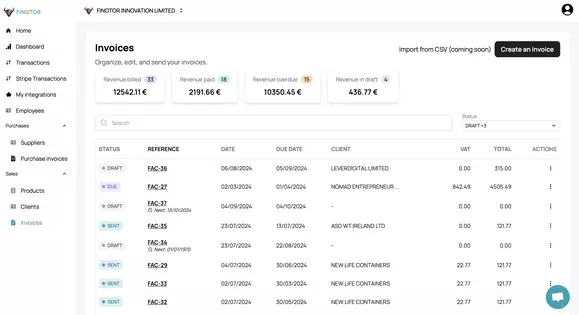

Not only will you get paid faster, but you’ll also be able to track your invoices more closely. This way, you can make sure that all your customers pay on time and that no money is lost in the process. Invoice Smarter also offers analytics and reports so you can track your progress and better understand who is paying you and when.

Harness the power of gratitude

Sending an invoice with a smile doesn’t just make you pay faster. It also shows your customers that you are grateful for their trust. This simple gesture can help create a lasting relationship with your customers.

By expressing your gratitude, you make your customers feel appreciated and valued. This can be done through a simple note, a sincere thank you or even a small token of appreciation. Invoice Smarter helps you incorporate this into your payment strategy and allows you to continually show your customers how much you appreciate them.

Make billing fun with Finotor

Finally, Invoice Smarter makes billing fun again. By streamlining the process and adding a touch of personalization, you can make billing a more enjoyable experience. Plus, the analytics and reporting features allow you to track your progress and help you make better decisions in the future. So you can continue to provide excellent service to your customers and ensure you get paid on time.

Whatever your payment strategy, Invoice Smarter makes it easier and more efficient. With the power of gratitude and a smile, you can get paid faster, smarter and happier. So go ahead, make your bills smile and get paid!

FAQ: How to Invoice Smarter for Better Business Performance

1. What does it mean to invoice smarter?

Invoicing smarter means using efficient, automated tools and best practices to manage your invoicing process. It involves reducing manual tasks, minimizing errors, and ensuring that invoices are sent out promptly to improve cash flow and financial management.

2. Why is smart invoicing important for my business?

Smart invoicing helps streamline your payment process, reduces the risk of late or missed payments, and improves cash flow. By automating invoices, you can ensure accuracy and consistency, which ultimately boosts efficiency and helps maintain a positive relationship with your clients.

3. What are the key benefits of automating my invoicing process?

Automating your invoicing process offers several benefits:

• Saves time and reduces manual effort

• Minimizes errors in billing

• Ensures timely invoicing and faster payments

• Improves cash flow

• Provides accurate financial records for reporting and analysis

4. How can invoicing smarter improve cash flow management?

By sending invoices on time and using automated follow-up reminders, smart invoicing ensures that payments are collected more efficiently. This reduces delays and helps maintain a steady cash flow, which is crucial for covering operational expenses and planning for growth.

5. What tools can I use to automate my invoicing?

You can use cloud-based invoicing platforms or accounting software like Finotor to automate your invoicing process. These tools allow you to schedule recurring invoices, track payments, and send automated reminders, making it easier to manage your financial transactions.

6. How can I reduce invoicing errors?

To reduce invoicing errors, use invoicing software that automatically calculates totals, applies taxes, and ensures all necessary details are included. Double-check customer information, item descriptions, and amounts before sending, and ensure that you use standardized templates for consistency.

7. What should an ideal invoice include?

An ideal invoice should include:

• Business name and contact information

• Client details

• Invoice number and date

• Description of goods or services provided

• Total amount due, including taxes

• Payment terms and due date

• Payment methods accepted

8. How do payment terms impact invoicing?

Payment terms clearly state when the payment is due (e.g., “Net 30” means payment is due 30 days from the invoice date). Clear payment terms help avoid misunderstandings and ensure both parties are on the same page regarding when payments should be made.

9. Can invoicing smarter help reduce payment delays?

Yes, invoicing smarter, such as using automated reminders, helps reduce payment delays by keeping your clients informed of due dates and ensuring they don’t overlook invoices. You can also offer multiple payment options to make it easier for clients to pay on time.

10. How does smart invoicing impact client relationships?

By invoicing smarter, you ensure that your invoicing process is professional, accurate, and timely. This builds trust and reliability with your clients, enhancing long-term business relationships.

11. What are some invoicing best practices for small businesses?>

Some best practices for smart invoicing include:

• Automating the invoicing process

• Sending invoices promptly after service delivery

• Clearly stating payment terms and due dates

• Offering multiple payment methods

• Using a consistent and professional invoice format

12. Can smart invoicing help with financial reporting?

Yes, smart invoicing systems automatically track all invoice-related transactions, providing accurate records for financial reporting. This ensures that you have up-to-date data for cash flow management, budgeting, and financial analysis.

13. How can Finotor help me invoice smarter?

Finotor offers automated invoicing features that help businesses streamline their billing processes, reduce errors, and improve cash flow. It integrates with other financial tools for seamless management of payments and invoices, allowing you to focus on growth and operational efficiency.

These practices and leveraging tools like Finotor, your business can invoice smarter, improving your financial health and boosting client satisfaction.