Contents

5 secrets for earning more and managing less…

The concept of earning more and managing less is one of the biggest issues for any entrepreneur, even an experienced one . It seems unattainable, especially if you have a growing business.

So…

How can you be more productive?

How can you free yourself from this mental burden?

How can you concentrate on creating real value?

For decades, numerous studies have shown that working non-stop and always feeling obliged to be ‘on time’ has harmful effects on our physical and mental health, as well as on the quality of our personal relationships. This constant pressure also prevents us from taking full advantage of other essential aspects of life, such as leisure, travel or simply time for ourselves. It’s very important to remember that you are much more than your work, even if your work is your passion or the cause to which you devote your heart and soul.

In this context, it is possible to work less and earn more, especially as an entrepreneur or manager.

So I’m going to tell you four secrets to help you do just that.

Not only will these strategies enable you to earn more and manage less, they will also help to increase your organisation’s profits. What’s more, they’ll help your team members feel more autonomous and valued in their work. That’s what we call a win-win situation for you, your company and your employees!

Sharing the vision, sharing the load

Here’s a perspective that many entrepreneurs and business leaders don’t immediately grasp: although salary is a unique and sufficient factor for their teams, and increasingly so, and often one of the determining factors in the acceptance of a new job, it is not always the most essential aspect of the professional experience. A competitive salary only creates a transactional relationship between the employee and the company. When the company runs into difficulties, an employee motivated solely by money is likely to be among the first to look for a way out.

On the other hand, when an employee identifies with the organisation’s purpose, vision or mission – whatever you want to call it – the relationship becomes transformational. These employees are more likely to get through difficult times alongside the company, because they are deeply connected to the meaning of their work.

Think of this through the analogy of a marriage. If you choose to marry someone simply for their looks or wealth, what happens when those attributes disappear? On the other hand, if your union is based on a shared belief or a common vision of life, you’ll be more willing to endure hardship together.

For a leader, the ability to articulate a clear vision and align employees around a common goal is beneficial in the medium and long term. When employees feel invested in a cause beyond themselves, they are more inclined to commit fully to their work. This enables managers to delegate more and focus on crucial strategic aspects, which not only optimise their use of time, but also fuel their passion and raison d’être at work.

By defining and sharing the organisation’s vision and objectives, you encourage your team to take more initiative and responsibility, freeing up time to focus on activities that promote both the company’s success and your own mental well-being.

Empower the experts around you

The recruitment practices of many companies may seem confusing at first. During an interview, they try to find out about a potential candidate’s achievements, background and values. Once that person has been vetted and they feel the candidate can do the job, they hire them and agree to pay them a certain amount of money in exchange for taking on the new role. But then something interesting happens.

Despite having approved this person and being convinced of their skills, the managers immediately micromanage the new recruit’s work. This makes sense from one point of view, as you want to make sure they understand your core business processes. But it can quickly erode trust and add workload to your already overloaded plate.

If you want to work less but earn more, the simplest route is to trust your people to do what they do best. If you’re a manager in an organisation, of course you need to be involved in certain initiatives or projects. But these are few and far between and tend to have an impact on long-term strategy, brand image or market position. Believing that you have to be involved in every project will make you work harder, not less. Instead, take a step back and give the people you’ve hired the means to do the job you’ve recruited them to do.

Give the experts around you autonomy

Recruitment practices in many companies can seem complex at first. During an interview, the company seeks to assess the candidate’s achievements, track record and values. Once the candidate has been selected, the company decides to take them on and offers them a salary in exchange for their work. However, an interesting situation often arises later on.

Despite their initial confidence in the candidate’s ability to carry out their tasks, managers sometimes start to keep a close eye on their work, to the point of micro-managing every stage. This may seem understandable to a certain extent, as they want to ensure that the new recruit adapts well to the company’s internal processes. However, this behaviour can quickly undermine the employee’s confidence and add extra tasks to your already heavy workload.

If your aim is to reduce your workload while increasing your profits, the key lies in the trust you place in your employees. As a manager, your role naturally involves getting involved in certain projects or initiatives. However, these projects should be few and far between, and focus on long-term strategic aspects such as brand image or market position.

If you feel you have to be involved in every project, you risk overloading yourself unnecessarily. Instead, take a step back and let the professionals you have recruited use their skills to carry out the tasks for which they have been hired.

Regain control of your time

Numerous studies have sought to establish a link between the number of hours worked and actual productivity. Research conducted by Franck Brunet of Dublin University shows that an employee’s productivity drops considerably after 50 hours a week, and collapses completely after 55 hours. In fact, a person working 70 hours produces practically nothing more than if they had stopped at 55 hours.

Working 55 hours a week is still a significant burden – it represents 11 hours a day over a five-day week – but it’s still preferable to the 70 or 80 hours that some managers regularly impose on themselves. The key point to remember is that productivity is depleted as the workload increases.

A simple example of this is IT support or customer service for most technology products. What are you often advised to do if you have a problem? “Reboot” or “switch off and on again”. It’s become a cliché, but this method also works for us humans: we need pauses and restarts to remain efficient.

Unsurprisingly, one of the secrets to working less is making a conscious choice to reduce your workload. Don’t convince yourself that an 80-hour week is the only path to success. Take back control of your schedule.

Align strategy and execution

In any organisation, there is often a distinction between ‘strategy’, which is the long-term vision defining the direction to be taken based on market position and internal capabilities, and ‘execution’, which is the day-to-day actions required to realise that vision.

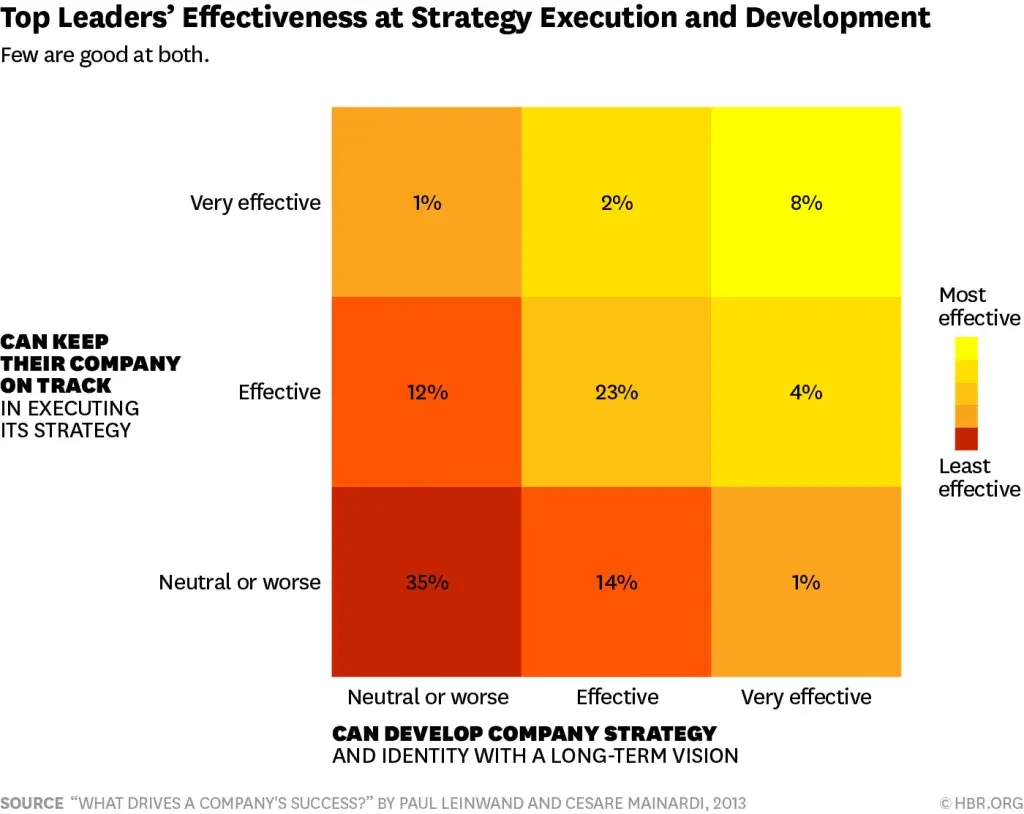

However, in many companies, these two elements are not always well aligned. This chart from Harvard Business Review shows that only 8% of senior managers have the ability to align strategy and execution:

This is one of the main reasons why you, and other leaders in your organisation, end up overwhelmed with work. When day-to-day tasks don’t align with the strategic vision, leaders feel compelled to get more involved in the details to get projects back on track.

It is essential to devote more time to ensuring that the day-to-day actions of everyone in the organisation are in line with the long-term vision. When day-to-day execution reflects the strategic objectives, the business runs optimally, reducing the need for constant intervention and freeing up time and energy. You’ll be able to reduce your workload while remaining productive.

Although work-life balance may seem like a distant concept, especially for those who are heavily invested in growing their business, it is entirely achievable with a few adjustments to the way we think about and harmonise our work. Adopt these four strategies, and you’ll soon find that you can achieve more while working less.

What other tactics have you tried to earn a little more by working a little less?

How Finotor Can Help You Earn More and Manage Less

Finotor, as an automated business finance management platform, is positioned as a key tool for entrepreneurs and managers who want to optimise their time while increasing their profitability.

Here’s how Finotor can help:

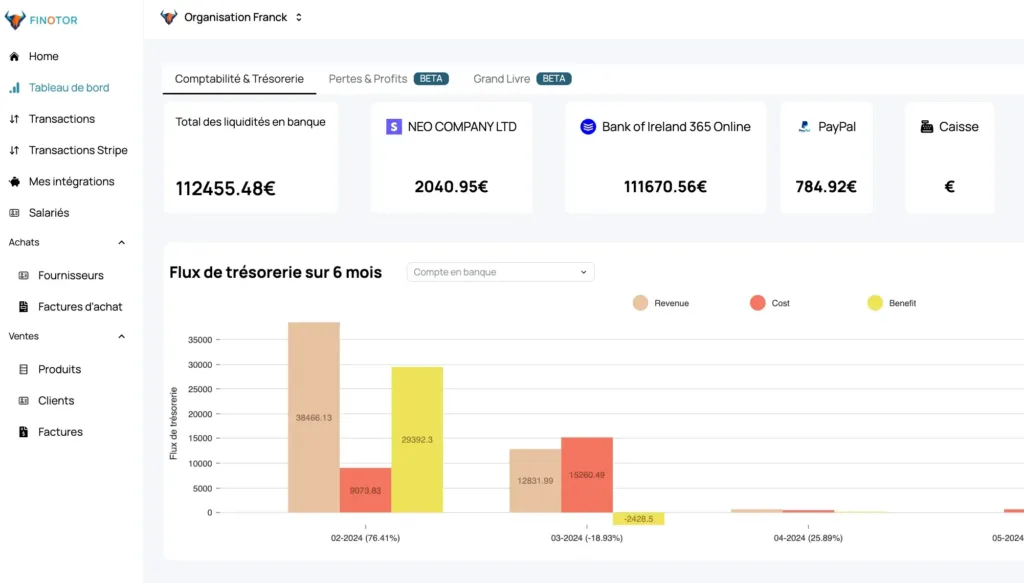

- Automating Repetitive Tasks: Finotor automates many accounting and financial tasks that would otherwise take up valuable time for you or your team. This includes managing invoices, tracking payments, generating financial reports, and more. By reducing the need to micromanage these aspects, you free up time to focus on strategic, higher value-added activities.

- Improved Financial Visibility: With its real-time reporting and analysis tools, Finotor provides a clear view of your company’s financial health. This allows you to make informed decisions quickly, without having to dive into complex spreadsheets or wait for monthly reports. Better visibility leads to more informed decisions, which can increase your company’s revenues and profitability.

- Align Strategy and Execution: Finotor facilitates alignment between your company’s long-term financial strategy and day-to-day execution. By providing you with accurate and up-to-date information, it enables you to ensure that resources are allocated efficiently and in line with strategic objectives. This reduces the need for constant correction and micro-management, allowing the team to work more autonomously and in a more focused way.

- Reduce Costs and Maximise Profits: By identifying inefficiencies and automating processes, Finotor helps to reduce operational costs. Less time spent on administrative tasks means more time to develop growth strategies, explore new market opportunities, or improve service/product offerings. This can lead to increased revenues without increasing the workload.

- Support for Sustainable Growth: With tools designed to manage financial complexity as your business develops, Finotor ensures that growth remains sustainable. By enabling smooth financial management even on a large scale, the platform ensures that the management burden does not increase exponentially as your business grows.

Finotor is more than just a financial management tool; it’s a catalyst that enables managers to work smarter, delegate effectively, and focus on the strategic initiatives that lead to profitable growth. With Finotor, you can earn more by working less, while ensuring smooth and efficient management of your financial operations.