Contents

- 1 This article and bookkeep your company

- 2 The Importance of Bookkeeping for Businesses

- 3 Types of Bookkeeping Systems

- 4 Basic Bookkeeping Principles

- 5 Benefits of Proper Bookkeeping

- 6 How to Set Up a Bookkeeping System

- 7 Common Bookkeeping Mistakes to Avoid

- 8 Outsourcing Bookkeeping Services

- 9 Frequently Asked Questions

Effective bookkeeping serves as the foundation of any successful business, ensuring that financial records are accurate, organized, and current. Accounting software like Finotor and accounting automation software can help you efficiently with the best accounting teams and finance teams. QuickBooks Online is a versatile accounting solution that integrates with other platforms. Bookkeep your company with accounting automation tools can focus on providing strategic insights and advisory services. This shift enhances their value within organizations.

This article and bookkeep your company

This article examines the importante role that book keep plays, comparing manual and computerized systems while emphasizing essential principles for maintaining clear records. It outlines the numerous advantages of robust bookkeeping practices, provides practical steps for establishing an effective system, and identifies common pitfalls to avoid.

The Importance of Bookkeeping for Businesses

Bookkeeping is essential for maintaining accurate financial records within organizations, serving as the foundation of effective financial management and ensuring that all accounting practices comply with regulatory standards. Accounting software and accounting automation can help you be more efficient by automating mundane data entry and avoid manual tasks. Continuous accounting can further automate processes and improve financial oversight by continually monitoring and reconciling financial data, which helps in proactively detecting and preventing fraud.

Proper bookkeeping enables businesses to track their revenue and expenses, manage payroll, and prepare financial statements, all of which are critical for tax compliance and financial analysis.

Furthermore, the advent of bookkeeping software and online bookkeeping solutions has enhanced the efficiency of record-keeping, allowing businesses to streamline their operations and concentrate on growth while safeguarding their financial health.

Understanding the Role of Bookkeeping

Understanding the role of bookkeeping is crucial for effective financial management, as it entails the systematic recording of financial transactions that accurately reflect a business’s overall economic activities. This process includes maintaining ledgers, tracking accounts payable and receivable, and preparing essential financial documents such as income statements and balance sheets.

By implementing a robust bookkeeping system, businesses can ensure precise financial oversight, which enables them to make informed decisions and uphold financial discipline.

And with an accounting tool that streamlines various accounting functions, including accounting software and accounting automation, no more confusing journal entries from multiple sales channels and websites.

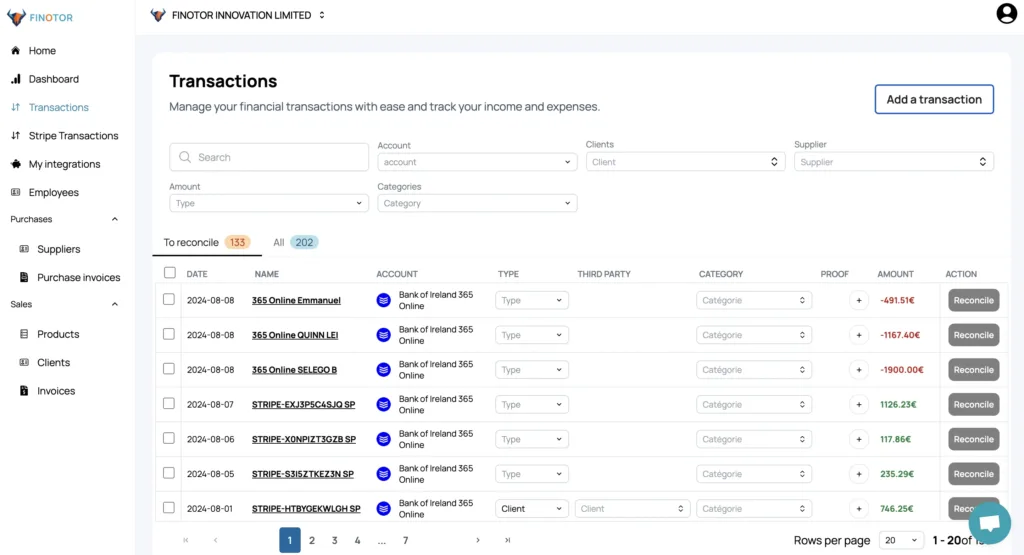

Bookkeep your company with Finotor

Diligent bookkeeping practices

Diligent bookkeeping practices not only enhance transparency but also ensure compliance with various legal and regulatory standards. Accurate journal entries are crucial for maintaining financial health, as they provide a clear overview of the company’s financial status without the need for complex calculations or checking multiple platforms. This necessitates that bookkeepers are proficient in utilizing diverse bookkeeping techniques, such as double-entry accounting and electronic record-keeping, thereby improving efficiency and minimizing the likelihood of errors.

Regular reconciliation of bank statements and meticulous monitoring of cash flow further reinforce a company’s financial health. Ultimately, by adhering to rigorous standards of financial documentation and recording methods, the organization can foster trust among stakeholders and position itself for long-term success.

Types of Bookkeeping Systems

A comprehensive understanding of the various types of bookkeeping systems is essential for businesses, as it directly influences the management of their financial records, whether via traditional manual methods or contemporary computerized solutions.

Manual bookkeeping depends on paper-based ledgers and records, which can be time-consuming and susceptible to errors. In contrast, computerized bookkeeping employs advanced financial software that automates numerous processes, thereby streamlining data entry and reconciliation.

By carefully evaluating the distinctions between these systems, businesses can select the most appropriate bookkeeping tools to improve operational efficiency and ensure financial accuracy.

Manual vs. Automated Bookkeeping Software

Manual bookkeeping refers to the traditional methods of recording transactions by hand in ledgers, whereas computerized bookkeeping employs financial software to automate and streamline these processes, leading to improved efficiency and accuracy. While manual methods may offer simplicity, they require a substantial investment of time and are prone to human error.

In contrast, computerized systems facilitate enhanced financial tracking, automatic reconciliations, and easier access to financial data, enabling businesses to concentrate on strategic growth.

For example, a small business may find manual bookkeeping manageable when handling a limited number of transactions and straightforward financial records. However, as the business grows and the volume of financial activities increases, the probability of errors rises, and the need for timely reporting becomes critical. In such cases, transitioning to a computerized bookkeeping system can provide significant advantages, including real-time financial insights and the capacity to generate reports with ease.

While manual methods may be suitable for smaller, less complex operations, computerized systems generally represent a necessary upgrade for growing businesses that require robust financial management and bookkeeping practices to meet their evolving needs.

Basic Bookkeeping Principles

Fundamental bookkeeping principles are essential for ensuring accurate record-keeping and maintaining financial integrity within a business’s accounting practices. Reconciling sales data against payment deposits is crucial for accurate financial reporting. These core principles encompass the significance of maintaining a comprehensive chart of accounts, consistently updating journal entries, and adhering to established financial regulations to ensure compliance.

By following these practices, businesses can minimize bookkeeping errors, enhance financial reporting efficiency, and promote strong financial governance.

Accurate Record-Keeping, Expense Tracking, and Organization

Accurate record-keeping and organization are essential elements of effective bookkeeping, enabling businesses to maintain clear and precise financial documentation. This requires ensuring that all transactions are recorded systematically, utilizing a comprehensive bookkeeping checklist to monitor critical financial metrics such as income, expenses, and cash flow. Proper organization facilitates easy access to financial records, which in turn supports timely reconciliations and efficient reporting.

To enhance these practices, the adoption of digital bookkeeping systems can significantly streamline the process, reducing errors and conserving time. Numerous software solutions are available that not only automate data entry but also provide real-time insights into financial performance.

Implementing consistent bookkeeping documentation practices ensures that all records are thorough and well-organized. This ultimately promotes better financial management, enabling businesses to respond swiftly to any discrepancies and make informed decisions based on accurate data.

Benefits of Proper Bookkeeping

The advantages of proper bookkeeping extend well beyond basic record-keeping; they play a crucial role in enhancing financial analysis and facilitating strategic decision-making. By maintaining accurate financial records, businesses can effectively assess their cash flow, manage expenses, and analyze revenue trends through comprehensive financial statements, such as profit and loss statements.

This level of clarity not only supports improved financial oversight but also enables business owners to make informed decisions that promote growth and sustainability.

Financial Data Analysis and Decision Making

Effective bookkeeping significantly enhances financial analysis and decision-making by providing essential data for evaluating a business’s performance and facilitating strategic choices. With precise financial records in place, business owners can identify key performance indicators, assess trends, and gather financial insights that inform decisions regarding budgeting, cash management, and long-term planning.

This analytical approach fosters a comprehensive understanding of financial health, guiding businesses to navigate challenges and seize opportunities.

Reliable bookkeeping practices ensure accountability, enabling businesses to meet regulatory requirements and establish trust with stakeholders. By systematically organizing and categorizing financial transactions, decision-makers gain visibility into their operational efficiency and profitability—critical components for developing accurate financial projections.

This foresight allows businesses to allocate resources more effectively while considering sustainability; informed decisions can lead to responsible investments in eco-friendly practices that benefit both the corporation and the environment.

Ultimately, the integration of thorough bookkeeping into the decision-making process not only strengthens immediate financial management but also supports strategic objectives that promote long-term growth and resilience.

How to Set Up a Bookkeeping System

Establishing a comprehensive bookkeeping system is vital for any business seeking to maintain accurate financial records and optimize its bookkeeping processes. The accounting team plays a crucial role in managing financial transactions and ensuring accurate financial oversight. This entails selecting appropriate bookkeeping tools, such as financial software that aligns with the specific requirements of the business, and creating a well-defined workflow for managing financial transactions.

Furthermore, investing in bookkeeping training for staff is essential, as it provides them with the necessary knowledge to implement and sustain these systems effectively, thereby ensuring compliance and operational efficiency.

Steps and Tips for Implementation

Implementing a bookkeeping system necessitates meticulous planning and execution, encompassing several essential steps and considerations to ensure success. It is advisable to begin by evaluating the specific needs of the business, selecting appropriate bookkeeping services and tools, and establishing a systematic workflow for financial data entry and management.

Regular training and adherence to financial compliance are critical components, as they help to mitigate common bookkeeping errors and promote an organized approach to financial management.

To further enhance the bookkeeping process, it is imperative to regularly review and update the selected methods and tools in alignment with the growth and evolution of the business. Establishing automated systems to streamline repetitive tasks can significantly increase efficiency and reduce the likelihood of errors.

Additionally, incorporating cloud-based bookkeeping solutions facilitates seamless access to financial data from any location, thereby fostering collaborative opportunities across teams. Engaging with a knowledgeable bookkeeper or consultant on a periodic basis can provide valuable insights and guidance, ensuring ongoing compliance with best practices and regulatory requirements.

By cultivating a proactive and informed approach, businesses can establish a robust foundation for financial accuracy and integrity.

Common Bookkeeping Mistakes to Avoid

Avoiding common bookkeeping mistakes is essential for maintaining financial accuracy and ensuring effective record-keeping within any business.

Errors such as improper expense tracking, neglecting reconciliations, and failing to maintain a comprehensive bookkeeping checklist can result in inaccurate financial statements and compliance issues.

By recognizing these pitfalls and implementing best practices, businesses can improve their financial management and protect their financial stability.

Tips for Maintaining Accurate Records

Maintaining accurate records is essential for effective bookkeeping and can be accomplished through a variety of practical tips and strategies. Implementing a structured approach to data entry, utilizing automated bookkeeping tools, and regularly reviewing financial documentation significantly reduce errors and enhance financial tracking.

Establishing a consistent review process ensures compliance with financial regulations and promotes overall financial discipline.

One proactive method involves leveraging cloud-based accounting software, which streamlines the recording of transactions and provides real-time insights into financial performance. It is also beneficial to meticulously categorize expenses and income, as this simplifies tax preparation and aids in identifying spending patterns.

Regularly reconciling bank statements with recorded transactions is another recommended best practice, as it promptly highlights discrepancies and facilitates timely corrections. Additionally, employing automated reminders for invoicing and payment schedules can prevent overdue accounts, thereby enhancing cash flow management.

Collectively, these techniques create a robust framework for effective financial oversight.

Outsourcing Bookkeeping Services

Outsourcing bookkeeping services has become an increasingly favored strategy for businesses aiming to improve their financial management and optimize operational efficiency. By collaborating with professionals who specialize in small business accounting, organizations can benefit from expertise that ensures the maintenance of accurate financial records, thereby allowing internal resources to concentrate on growth strategies.

This method not only promotes financial sustainability but also enables companies to utilize advanced bookkeeping solutions that may be impractical to implement internally.

Pros and Cons of Hiring a Professional

When considering the engagement of a professional for bookkeeping services, it is essential to thoroughly evaluate the advantages and disadvantages to determine whether this approach aligns with the financial objectives of the business. The benefits include access to specialized skills in financial analysis, significant time savings, and improved accuracy in record-keeping, all of which can greatly enhance financial oversight.

Conversely, potential drawbacks may involve the cost of services and a diminished degree of control over internal bookkeeping processes. Therefore, it is critical to assess these factors in relation to the specific needs of the business.

For example, a company experiencing rapid growth may find it advantageous to outsource its bookkeeping functions in order to effectively manage the increasing volume of transactions. This professional assistance can contribute to better tax compliance and provide insightful financial reporting.

Conversely, a small business with a stable revenue stream might opt to manage its bookkeeping internally to reduce costs. It is imperative for each business owner to evaluate their unique circumstances, weighing the convenience of outsourcing against potential disadvantages, such as dependence on an external entity for the management of vital financial data.

Frequently Asked Questions

1. What is bookkeeping and why is it important for my company?

Bookkeeping is the process of recording and organizing financial transactions for a business. It is important because it allows you to track your company’s income and expenses, monitor cash flow, and make informed decisions about your business’s financial health.

2. Do I need to hire a professional bookkeeper for my company?

It depends on the size and complexity of your company’s financial transactions. If you have a small business with minimal transactions, you may be able to handle the bookkeeping yourself. However, if your business is larger or has more complex financial needs, it may be wise to hire a professional bookkeeper to ensure accuracy and compliance.

3. What are the basic bookkeeping tasks I should be doing for my company?

At the very least, you should be recording all financial transactions, keeping track of invoices and receipts, reconciling accounts, and creating financial statements. It’s also important to keep your bookkeeping records organized and up-to-date.

4. How often should I be bookkeeping for my company?

It’s recommended to bookkeep on a regular schedule, whether it’s weekly, bi-weekly, or monthly. This allows you to stay on top of your company’s financial records and catch any errors or discrepancies early on.

5. Can I use accounting software to manage my company’s finances?

Yes, there are many bookkeeping software options available that can help you streamline your bookkeeping tasks and keep your records organized. Just make sure to choose a software that is user-friendly and meets the needs of your business.

6. What are some common mistakes to avoid when bookkeeping for my company?

Some common mistakes to avoid include failure to accurately record transactions, not reconciling accounts regularly, and mixing personal and business finances. It’s also important to stay on top of tax deadlines and keep all important financial documents organized and easily accessible.