Contents

- 1 1- What is a Chart of Accounts?

- 2 2- Understanding the structure of a chart of accounts

- 3 3- Income Statement Accounts

- 4 4- Balance Sheet Accounts

- 5 5- Key Purposes and Benefits of a Robust Chart of Accounts

- 6 6- Integration with Finotor

- 7 5- Importance of a Well-Structured Chart of Accounts

- 8 6- Tailoring Your Chart of Accounts to Meet Business Needs

- 9 FAQ: Chart of Accounts for a Consulting Firm

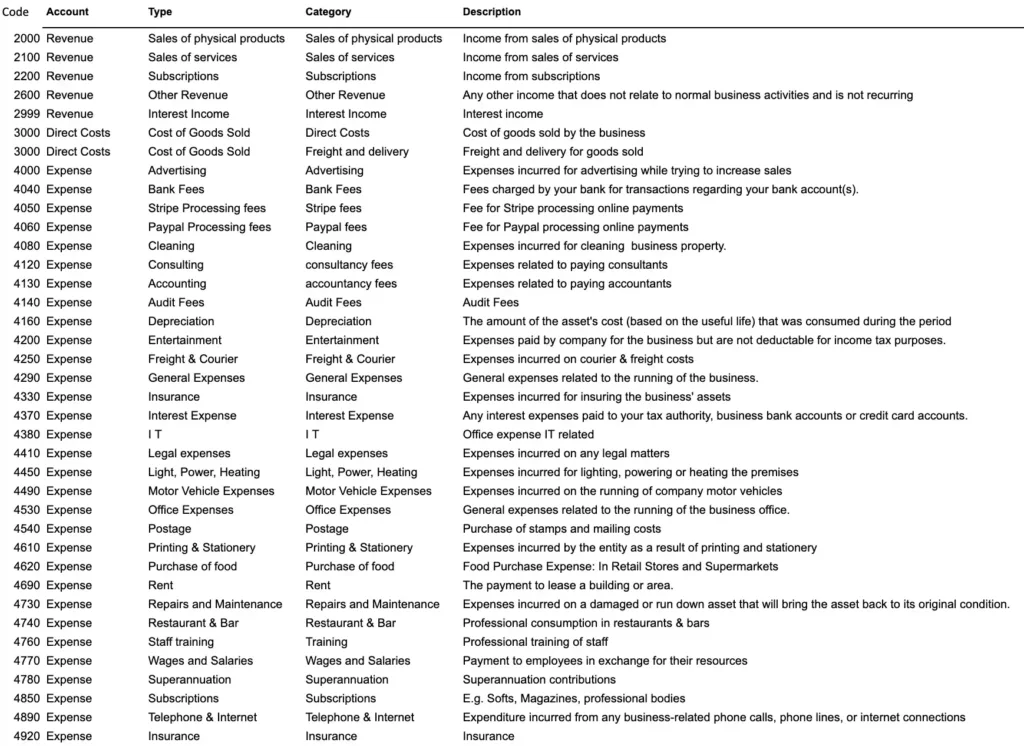

Chart of Accounts Example for a Consulting Firm

Creating a well-structured chart of accounts is essential for effective financial management in any consulting firm. An income statement account is essential for summarizing a business’s revenue and expenses over time. This guide provides an example of a chart of accounts, categorized into income statement and balance sheet accounts, tailored to meet the needs of a consulting business.

1- What is a Chart of Accounts?

A chart of accounts is a comprehensive list of all the financial accounts in a company’s general ledger. It’s a very important part for an income statement accounts. It serves as a blueprint for a company’s financial architecture, providing a clear picture of every area of the business that spends or makes money.

This tool is indispensable for any small business ready to grow to the next level, as it simplifies financial analyses and enhances financial management. By creating a chart of accounts, businesses can organize their finances, separate expenditures, revenue, assets, and liabilities, and gain a clear understanding of their overall financial health.

This structured approach ensures that all financial accounts are systematically categorized, making it easier to track financial transactions and generate accurate financial reports.

2- Understanding the structure of a chart of accounts

A chart of accounts is the backbone of any accounting system. It’s a systematic list of all accounts used by a business to record financial transactions. The structure typically follows a hierarchical pattern, categorizing accounts into five main groups :

- Assets (account numbers starting with 1)

- Liabilities (account numbers starting with 2)

- Equity (account numbers starting with 3)

- Revenue (account numbers starting with 4)

- Expenses (account numbers starting with 5-9)

This structure provides a clear overview of a company’s financial position and performance. Let’s break down each category with some common examples :

| Category | Examples |

|---|---|

| Assets | Cash, Accounts Receivable, Inventory, Equipment |

| Liabilities | Accounts Payable, Loans, Taxes Payable |

| Equity | Owner’s Capital, Retained Earnings |

| Revenue | Sales Revenue, Service Revenue |

| Expenses | Cost of Goods Sold, Salaries, Rent, Utilities |

Having co-founded multiple businesses, including an AI-powered financial management solution, I can attest to the importance of a well-organized chart of accounts. It’s not just about listing accounts; it’s about creating a logical framework that supports efficient financial operations.

3- Income Statement Accounts

Here is an example :

Revenue Accounts

- 2000 – Sales : Income from sales

- 4000 – Consulting Fees: Income from consulting services provided.

- 4010 – Project Management Fees: Income from project management services.

- 4100 – Sales Revenue: General sales income, including any products or additional services.

- 4200 – Other Income: Income from non-consulting services, such as training or seminars.

Revenue accounts are a type of income statement account that track any income the business generates from various sources.

Expense Accounts

5000 – Administrative Expenses: Expense accounts are a type of income statement account that record all the money and resources spent in the process of generating revenues.

5001 – Office Supplies: Expenses for office supplies.

5002 – Rent Expense: Office rent payments.

5003 – Utilities Expense: Utility costs like electricity, water, and internet.

5010 – Travel Expenses: Costs of business travel.

5020 – Wages Expense: Salaries and wages for employees.

5030 – Depreciation Expense: Depreciation of office equipment.

5040 – Marketing Expenses: Costs related to advertising and promotions.

5050 – Professional Fees: Payments for legal, accounting, or consulting services.

4- Balance Sheet Accounts

Balance sheet accounts are essential components of financial statements that record and categorize transactions such as assets, liabilities, and shareholders’ equity at a specific point in time.

These accounts provide an overview of what a business owns (assets), owes (liabilities), and the residual interest in the assets of the business (equity).

Examples of balance sheet accounts include Cash, Accounts Receivable, Inventory, Accounts Payable, and Retained Earnings. Asset accounts record everything a company owns, including current and noncurrent assets, while liability accounts record everything a company owes, including current and noncurrent liabilities.

This detailed categorization helps businesses maintain a clear and accurate record of their financial position, facilitating better financial management and decision-making.

Asset Accounts

- 1000 – Current Assets:

- 1010 – Cash and Cash Equivalents: Cash on hand and in bank accounts.

- 1020 – Accounts Receivable: Amounts due from clients.

- 1030 – Prepaid Expenses: Payments made in advance for goods or services.

- 1040 – Marketable Securities: Short-term investments.

- 1100 – Fixed Assets:

- 1110 – Office Equipment: Value of office equipment.

- 1120 – Intangible Assets: Non-physical assets like patents or trademarks.

Liability Accounts

- 2000 – Current Liabilities:

- 2010 – Accounts Payable: Money owed to suppliers.

- 2020 – Invoices Payable: Unpaid vendor invoices.

- 2030 – Accrued Expenses: Expenses incurred but not yet paid.

- 2040 – Wages Payable: Salaries and wages owed to employees.

- 2100 – Long-term Liabilities:

- 2110 – Bank Loans: Long-term debt obligations.

Equity Accounts

- 3000 – Shareholders’ Equity:

- 3010 – Common Stock: Value of common shares issued.

- 3020 – Retained Earnings: Earnings retained in the business for growth.

5- Key Purposes and Benefits of a Robust Chart of Accounts

A robust chart of accounts is essential for financial reporting and analysis, as it provides a clear picture of a company’s financial health. It helps businesses comply with financial reporting standards, identify areas of improvement, and make informed business decisions.

A well-organized chart of accounts also helps to prevent fraud by keeping an organized and updated record of financial transactions. Additionally, a chart of accounts is beneficial for e-commerce businesses, as it helps to separate expenditures, revenue, assets, and liabilities, providing a clear understanding of their overall financial health.

By using accounting software, businesses can automate their chart of accounts, streamline their payment processes, and reduce the risk of late payments. This automation not only saves time but also enhances accuracy, ensuring that financial data is always up-to-date and reliable.

A meticulously crafted chart of accounts serves multiple purposes that are critical for business success. As Benjamin Franklin once said, “By failing to prepare, you are preparing to fail.” This adage perfectly encapsulates the importance of a well-structured chart of accounts. Here are the primary purposes it serves :

- Organizing financial transactions

- Providing a foundation for accurate financial reporting

- Aiding in budgeting and financial analysis

- Simplifying tax preparation

- Offering a comprehensive overview of business finances

The benefits of a well-organized chart of accounts extend beyond mere organization. They include :

Improved financial record keeping : A properly structured chart of accounts ensures that every transaction is recorded in the right place, reducing errors and inconsistencies.

Easier generation of financial statements : With a clear structure, creating balance sheets and income statements becomes a straightforward process.

Better understanding of business finances : It provides a clear picture of where money is coming from and where it’s going, enabling better decision-making.

Simplified reporting to investors and lenders : A well-organized chart of accounts makes it easier to present financial information to stakeholders, potentially improving access to capital.

In my 15 years of experience guiding companies towards growth, I’ve seen how a thoughtfully designed chart of accounts can be a game-changer for businesses of all sizes.

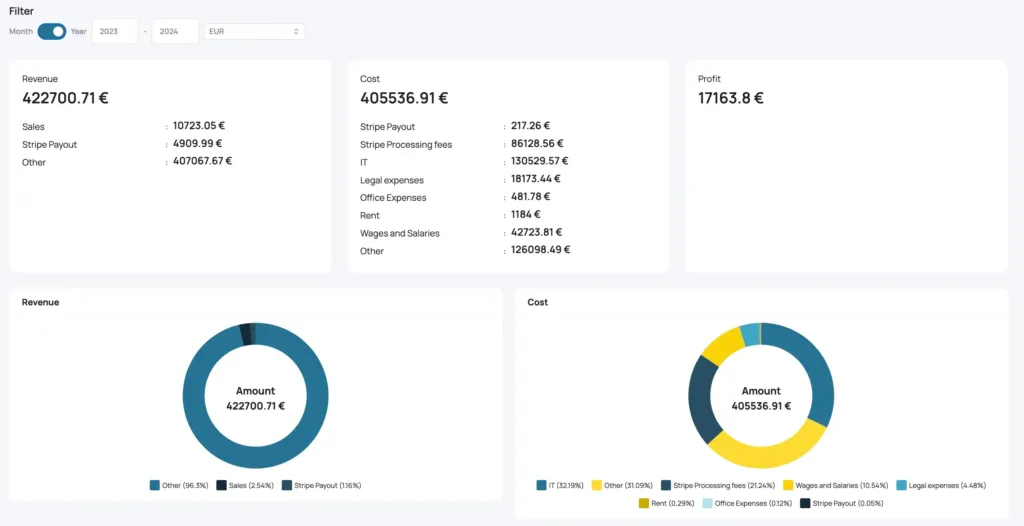

6- Integration with Finotor

For seamless financial management, consider integrating your chart of accounts with Finotor, accounting software. This software package offers:

- Automatic Bank Reconciliation: Saves time by automatically categorizing transactions using AI models.

- Financial Analysis Tools: Provides insights into your business’s financial health.

- Sales Management Features: Enables efficient handling of sales and customer data.

This chart of accounts is designed to organize and categorize all transactions effectively, providing a clear overview of the company’s financial standing while ensuring compliance with financial reporting standards. When integrated with Finotor, it becomes even more efficient, allowing for streamlined financial management and analysis.

With a well-structured chart of accounts and the right tools in place, a consulting firm can improve its financial management processes and make informed decisions to drive growth and success. So, it is recommended to adopt this practice for better financial management in your consulting business.

5- Importance of a Well-Structured Chart of Accounts

A well-structured chart of accounts serves as the backbone of an organization’s accounting system. It helps businesses track their financial health by systematically categorizing and recording all financial transactions.

A properly organized chart of accounts provides a clear understanding of the company’s assets, liabilities, equity, income, and expenses. This enables businesses to create accurate financial reports and make informed decisions based on reliable data.

Having a well-structured chart of accounts also ensures compliance with accounting standards and makes it easier for the business to undergo audits or file taxes. It helps in detecting any errors or discrepancies in financial records, preventing potential issues down the line. In addition, a well-organized chart of accounts can increase efficiency in bookkeeping processes and save time when generating financial statements.

6- Tailoring Your Chart of Accounts to Meet Business Needs

Every business is unique and has specific financial management needs. Thus, it is crucial to tailor the chart of accounts to meet the requirements of a consulting firm. While the basic structure remains the same, businesses can customize their chart of accounts by adding or removing relevant accounts based on their operations and services.

For instance, a consulting firm that specializes in IT services may have different revenue and expense accounts compared to a marketing consulting firm. By tailoring the chart of accounts, businesses can accurately track their financial performance and make data-driven decisions for growth.

Conclusion

A well-structured chart of accounts is an essential tool for effective financial management in a consulting firm. It provides a clear overview of the company’s financial standing and enables compliance with accounting standards.

By integrating it with Finotor, businesses can streamline financial processes and gain valuable insights into their financial health. It is recommended that consulting firms adopt this practice to improve their financial management and drive success in their business endeavors.

In conclusion, the chart of accounts plays a vital role in managing the finances of a consulting firm effectively. It serves as the foundation for accurate financial reporting, compliance with standards, and making informed decisions.

By understanding its importance and tailoring it to meet business needs, consulting firms can use their chart of accounts as a powerful tool for growth and success. And with the integration of advanced software like Finotor, they can achieve even greater efficiency and optimize their financial management processes.

FAQ: Chart of Accounts for a Consulting Firm

- What is a chart of accounts in a consulting firm?

A chart of accounts is a structured list of all accounts used by a business to categorize financial transactions. It helps consulting firms organize their finances by tracking assets, liabilities, revenue, and expenses. - Why is a well-structured chart of accounts important for a consulting firm?

A well-structured chart of accounts ensures accurate financial reporting, compliance with accounting standards, and better decision-making. It helps businesses manage their financial health effectively and supports easier tax preparation and audits. - What are the key categories in a chart of accounts for consulting firms?

The five key categories are:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

Each category tracks specific financial aspects like cash, accounts receivable, revenue from consulting services, and business expenses.

- Can I customize my chart of accounts for my consulting business?

Yes, consulting firms can tailor their chart of accounts to meet their specific needs. For example, a firm offering IT services may have different revenue and expense accounts compared to a marketing firm. - How does a chart of accounts benefit financial reporting?

It simplifies the generation of accurate financial statements like income statements and balance sheets. A clear chart of accounts enables businesses to analyze their financial performance, identify cost-saving opportunities, and make data-driven decisions. - What software can I use to manage my chart of accounts?

Software like Finotor is highly recommended for managing your chart of accounts. It offers features like automatic bank reconciliation, financial analysis tools, and sales management to streamline financial processes and provide real-time insights into your business’s financial health. - How does integrating Finotor improve financial management?

Integrating Finotor with your chart of accounts automates transaction categorization, saves time on reconciliation, and provides in-depth financial analysis. This integration ensures your consulting firm’s financial data is always accurate and up-to-date. - What are some examples of revenue and expense accounts for consulting firms?

- Revenue Accounts: Consulting fees, project management fees, and other income like training seminars.

- Expense Accounts: Office supplies, rent, utilities, wages, marketing expenses, and professional fees.

- How can a well-organized chart of accounts help with compliance?

A clear and organized chart of accounts ensures accurate tracking of all financial transactions, making it easier to comply with accounting standards and tax regulations. It simplifies the preparation of financial reports and audits. - Why should consulting firms adopt a chart of accounts system?

A chart of accounts provides structure to financial management, leading to better financial tracking, informed decision-making, and increased efficiency in bookkeeping processes. It’s essential for the long-term success and growth of a consulting business.