Contents

- 1 Understanding the basics of Etsy bookkeeping

- 2 Essential bookkeeping practices for Etsy sellers

- 3 Streamlining your Etsy bookkeeping process

- 4 Leveraging financial data for business growth

- 5 Choosing the Right Etsy Accounting Software

- 6 Taking your Etsy bookkeeping to the next level

- 7 FAQ: Bookkeeping for Etsy Sellers – Efficient Inventory Management

Managing your Etsy accounting when you have an Etsy store can be creatively rewarding, but keeping track of your finances is fundamental if not vital to sustainable success. Here’s how you can streamline your Etsy bookkeeping using Finotor and manage your finances effectively.

Essential Bookkeeping for Your Etsy Store :

Mastering Etsy bookkeeping is very important for online sellers to manage finances and drive business growth. Here’s a quick overview :

- Understand the basics : Record transactions, track sales, and manage inventory

- **Implement best practices :**Separate personal and business finances, choose the right accounting method

- Streamline processes : Utilize accounting software and Etsy-specific tools

- Leverage financial data : Analyze profitability, monitor cash flow, and make informed decisions

- Continuously improve : Explore advanced features, consider professional help, and stay informed about tax laws

As an Etsy seller, managing your finances effectively is a must for the success of your online business. Bookkeeping plays a vital role in keeping track of your income, expenses, and overall financial health. In this article, I’ll share essential tips and insights to help you master Etsy bookkeeping, streamline your financial processes, and boost your profitability by using the best accounting software for Etsy sellers.

Understanding the basics of Etsy bookkeeping

Bookkeeping for Etsy sellers involves recording and organizing financial transactions related to your online shop. Tracking and managing Etsy sales data is essential for streamlined bookkeeping. It’s the foundation for accurate accounting and financial analysis. As someone who has worked with innovative startups for over a decade, I can’t stress enough the importance of good bookkeeping for business growth.

The key bookkeeping tasks for Etsy sellers include :

- Tracking sales and expenses

- Managing inventory

- Recording Etsy fees and shipping costs

- Calculating profit margins

- Categorizing transactions

- Reconciling bank accounts

- Generating financial statements

By maintaining accurate records, you’ll be able to make data-driven decisions and identify areas for improvement in your Etsy business. In fact, according to a 2023 survey by the National Association of Small Business Owners, 82% of successful entrepreneurs attribute their growth to proper financial management.

Definition of Etsy Accounting

Etsy accounting refers to the meticulous process of managing and tracking all financial transactions and activities associated with running an Etsy business. This encompasses recording and categorizing income and expenses, managing inventory, calculating sales tax, and preparing comprehensive financial statements. Effective Etsy accounting is essential for maintaining the financial health and success of your Etsy business.

By using specialized accounting software and tools, Etsy sellers can streamline and automate these financial tasks, ensuring accurate and efficient financial management. Whether it’s calculating sales tax or tracking financial transactions, implementing a robust Etsy accounting system like Finotor is a must for the sustainability and growth of your business.

Importance of Accurate Accounting for Etsy Businesses

Accurate accounting is the backbone of any successful Etsy business. It ensures that you are making informed business decisions, managing your finances effectively, and staying compliant with tax laws and regulations. Without precise accounting, Etsy sellers may find it challenging to track their income and expenses, leading to financial errors, missed tax deductions, and poor business decisions.

Accurate accounting allows you to identify areas of your business that need improvement, optimize your pricing and inventory management, and scale your business for growth. By maintaining detailed and accurate financial records, you can make data-driven decisions that enhance your business’s profitability and sustainability.

Essential bookkeeping practices for Etsy sellers

To effectively manage your Etsy shop’s finances, consider implementing these best practices :

1. Separate your personal finances from those of your business: Open a dedicated business bank account so that business flows are also dedicated to your Etsy transactions. This separation makes it easier to track business expenses and simplifies tax preparation.

2. Choose the right accounting method : Decide between cash-basis or accrual accounting. This difference is characterized by the fact that cash accounting records transactions when money changes hands. Accrual accounting, on the other hand, records these same transactions as they are incurred, regardless of when payment is made.records transactions when money changes hands, while accrual accounting records them when they’re incurred, regardless of payment timing.

3. Track Etsy-specific fees : Etsy charges various fees, including listing fees, transaction fees, and payment processing fees. Accurate recording of these expenses is essential to understand your true profit margins.

4. Manage inventory effectively : Keep detailed records of your inventory, including costs, quantities, and reorder points. This information helps you make informed decisions about pricing and product offerings.

5. Stay on top of sales tax : Understand your sales tax obligations and use tools like TaxJar to manage collection and remittance across different jurisdictions.

As a writer passionate about corporate finance, I’ve seen firsthand how implementing these practices can transform a small Etsy shop into a thriving business.

Streamlining your Etsy bookkeeping process

To optimize your bookkeeping efforts and save time, consider the following strategies:

1. Utilize accounting software: Invest in user-friendly accounting software like Finotor, QuickBooks, Xero, or Sage. When choosing Etsy bookkeeping software, ensure the user interface is intuitive to facilitate ease of use. QuickBooks for Etsy is an option, but some users have reported limitations. Xero and Etsy integration is possible. However, Xero is often regarded as an unconvivial tool that is not very user-oriented, but more for accountants.

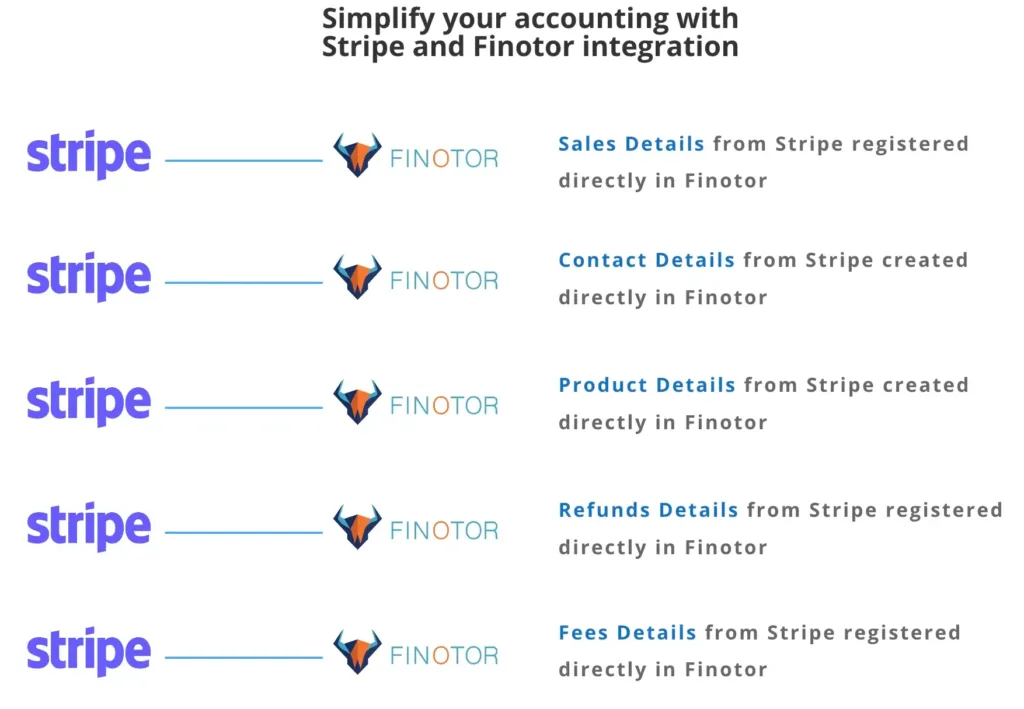

On the other hand, even if these tools can automate many accounting tasks and reduce errors, they remain generalist and don’t offer the detail of Stripe’s Payout, for example. Finotor, on the other hand, is highly interconnected with Stripe, enabling direct linkage of Stripe payout receipts recorded in Finotor, and above all automatic bank reconciliation of flows.

2. Integrate Etsy-specific tools: Use specialized integrations like A2X for Etsy to automatically import and categorize your Etsy transactions. This streamlines the reconciliation process and ensures accuracy.

3. Set up a regular bookkeeping schedule: Set up a schedule to ensure regular bookkeeping: set aside a few hours each week or month to keep track of your business and update your accounting entries.

4. Create a chart of accounts: Develop a clear system for categorizing your income and expenses. This organization makes it easier to generate meaningful financial reports and identify trends in your business.

5. Implement digital receipt management: Use apps to scan and store receipts digitally. This practice simplifies expense tracking and ensures you have proper documentation for tax purposes.

By implementing these strategies, you’ll significantly reduce the time spent on bookkeeping tasks, allowing you to focus more on growing your Etsy business.

Leveraging financial data for business growth

Effective bookkeeping goes beyond mere record-keeping; it provides valuable insights to drive your Etsy business forward. Here’s how you can leverage your financial data :

1. Analyze product profitability : Use your bookkeeping data to calculate the profit margins for each of your products. This analysis helps you identify your best-selling items and those that may need repricing or discontinuation.

2. Control the cash flow of your business: Steering your Etsy business through rigorous cash flow control ensures that you have sufficient cash to pay suppliers, invest in opportunities and leverage growth.This practice is crucial for maintaining a healthy business.

3. Identify tax deductions : Accurate bookkeeping helps you spot all eligible business expenses, maximizing your tax deductions and potentially lowering your tax liability.

4. Make informed pricing decisions : By understanding your costs and profit margins, you can set competitive prices that ensure profitability while remaining attractive to customers.

5. Plan for growth : Use financial projections based on your historical data to plan for expansion, such as introducing new product lines or hiring additional help.

To illustrate the impact of financial data on decision-making, consider the following table :

Financial Metric Impact on Business Decisions Gross Profit Margin Guides pricing strategies and product selection Operating Expenses Identifies areas for cost reduction and efficiency improvements Cash Flow Determines timing for inventory purchases and business investments Sales by Product Informs inventory management and marketing focus

By regularly reviewing these metrics, you can make data-driven decisions that propel your Etsy business forward. As someone who has worked with various startups, I’ve seen how this approach can lead to significant growth and success.

Choosing the Right Etsy Accounting Software

Selecting the right Etsy accounting software is important for streamlining and automating your financial tasks, reducing errors, and improving overall financial management. With a plethora of accounting software options available, it can be overwhelming to choose the right one. Here are some key features to look for in accounting software for Etsy sellers:

Key Features to Look for in Accounting Software

- Etsy Integration: Opt for accounting software that integrates seamlessly with Etsy, allowing for automatic import of sales data, fees, and other financial transactions.

- Inventory Management: Choose software that offers robust inventory management features, including tracking of stock levels, product variations, and cost of goods sold.

- Sales Tax Calculation: Ensure the software can accurately calculate sales tax and VAT, considering different tax rates and regulations.

- Expense Tracking: Look for software that allows easy tracking of business expenses, including categorization and tagging of expenses.

- Financial Reporting: Select software that provides detailed financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

- User-Friendly Interface: Choose software with an intuitive and user-friendly interface, making it easy to navigate and use.

- Customer Support: Ensure the software offers reliable customer support, including multiple support channels and resources.

Top Accounting Software Options for Etsy Sellers

-

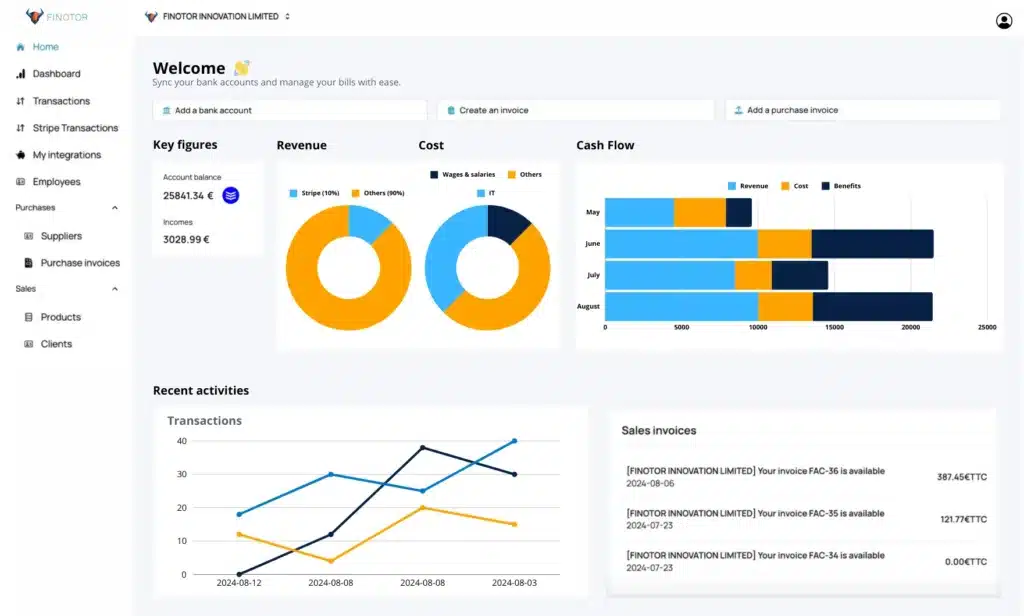

Finotor: AI-based accounting, business management and financial analysis software developed primarily for distance-selling activities. Finotor is particularly appreciated and used by the ecommerce sector for its time-saving automation features. Finotor offers a free account, which its competitors do not.

-

QuickBooks Online: A popular cloud-based accounting software that integrates with Etsy and offers robust features for inventory management, sales tax calculation, and financial reporting.

-

Xero: A cloud-based accounting software that offers seamless integration with Etsy, robust inventory management, and detailed financial reporting.

-

FreshBooks: A user-friendly accounting software that offers features for expense tracking, invoicing, and financial reporting, with integration with Etsy.

-

Wave: A free accounting software that offers features for expense tracking, invoicing, and financial reporting, with integration with Etsy.

- Sage: A robust accounting software that offers features for inventory management, sales tax calculation, and financial reporting, with integration with Etsy.

By considering these key features and top accounting software options, Etsy sellers can choose the right accounting software for their business, ensuring accurate and efficient financial management.

Taking your Etsy bookkeeping to the next level

As your Etsy business grows, you may need to consider additional steps to optimize your bookkeeping :

1. Explore advanced accounting software features : Many accounting platforms offer advanced reporting and forecasting tools. Familiarize yourself with these features to gain deeper insights into your business performance.

2. Consider professional help : If bookkeeping becomes too time-consuming or complex, consider hiring a bookkeeper or accountant specializing in e-commerce businesses. Their expertise can be invaluable, especially as you scale your operations.

3. Implement internal controls : As your business grows, establish checks and balances to prevent errors and fraud. This might include regular audits or separating financial duties among team members.

4. Stay informed about tax laws : Tax regulations for online sellers are constantly evolving. Stay up-to-date with changes that may affect your Etsy business and adjust your bookkeeping practices accordingly.

5. Invest in continuous learning : Attend workshops, webinars, or courses on small business finance to enhance your bookkeeping skills and financial literacy.

Remember, effective bookkeeping is an ongoing process that evolves with your business. By staying committed to financial organization and analysis, you’ll be well-positioned to achieve long-term success on Etsy.

It’s important to note that bookkeeping differs from accounting. While bookkeeping focuses on recording transactions, accounting involves analyzing financial data and providing insights. However, accurate bookkeeping is essential for reliable accounting.

Step 1: Understand Your Sales Volume

Your sales volume on Etsy may vary seasonally, so it’s important to regularly update your records to reflect fluctuations. Use Finotor to automate tracking, ensuring you have up-to-date data on your sales performance.

Step 2: Track Key Expenses

Categorizing your expenses is vital for clear financial insights and tax preparation. Here’s how you can organize your main expenses:

- Cost of Goods Sold (COGS): Account for all material and production costs associated with your products.

- Etsy Fees: Record listing fees, transaction fees, and any other charges from Etsy.

- Shipping and Packaging: Include costs for postage, packaging materials, and shipping insurance.

- Marketing and Advertising: Document spending on promotions, paid ads, and any other marketing initiatives.

- Office Supplies and Equipment: Keep track of purchases for supplies, tools, and office essentials.

- Utilities and Rent: If you have a dedicated workspace, include related utilities and rent expenses.

- Professional Services: Record fees for any professional services, such as accounting or design work.

- Software and Tools: Include subscriptions or purchases for applications used in Etsy management.

- Taxes and Licenses: Keep records of taxes paid and any business licenses or permits.

Step 3: Leverage Finotor for Efficient Bookkeeping

Finotor is a comprehensive software solution that can streamline your Etsy bookkeeping:

- Automated Data Entry: Sync your Etsy transactions with Finotor to reduce manual data entry.

- Expense Tracking: Use the software’s categorization features to effectively manage and review expenses.

- Financial Analysis: Generate insightful reports to analyze your business performance and make informed decisions.

- Tax Preparation: Simplify tax season with accurate records and detailed financial breakdowns.

Step 4: Regularly Review and Adjust

Set aside time each month to review your financial reports. This will help you identify trends, manage cash flow efficiently, and adjust your strategies as needed.

Conclusion

Efficient bookkeeping is the backbone of a successful Etsy store. By leveraging Finotor’s capabilities, you can stay on top of your finances and focus more on what you love—creating amazing products for your customers. Happy selling!

FAQ: Bookkeeping for Etsy Sellers – Efficient Inventory Management

- What is inventory management for Etsy sellers?

Inventory management involves tracking and controlling your stock of products to ensure you have the right amount of items available for sale at all times. It helps Etsy sellers keep their store well-stocked, avoid stockouts, and manage cash flow efficiently. - Why is inventory management important for Etsy sellers?

Effective inventory management ensures that you don’t run out of popular products and can meet customer demand. It also helps you avoid overstocking, which ties up capital in unsold items, and enables better cash flow management. - How can I track my Etsy shop’s inventory?

You can track inventory by using accounting and inventory management software like Finotor. These tools automate stock level updates, track sales, and generate reports that help you optimize your stock and prevent errors in bookkeeping. - How do I manage my Etsy inventory efficiently?

- Set reorder points for each product to automatically trigger restocking.

- Use software to track stock levels in real-time.

- Regularly audit your physical stock to ensure it matches your records.

- Implement Just-In-Time (JIT) inventory to reduce excess stock.

- How can inventory management improve my Etsy shop’s profitability?

By managing inventory properly, you can avoid overstocking, reduce holding costs, and make data-driven decisions on which products to promote. This leads to better cash flow management and improved profitability. - What tools can Etsy sellers use for inventory and bookkeeping?

Software like Finotor offers integrated bookkeeping and inventory management features. It helps automate stock tracking, order management, and financial reporting, allowing Etsy sellers to focus on growing their business. - How do I forecast demand for my Etsy shop?

Use historical sales data, seasonal trends, and market research to forecast demand. Tools like Finotor can help analyze this data, giving you insights to plan for future stock needs and avoid stockouts or overstocking. - How does Finotor help Etsy sellers with inventory management?

Finotor automates inventory tracking, updates stock levels in real-time, and provides detailed reports on product performance. This helps Etsy sellers keep their inventory balanced, avoid costly stockouts, and make better decisions for restocking. - How often should I update my Etsy shop’s inventory records?

Ideally, update your inventory records daily or whenever there’s a sale, new stock arrives, or you restock. Using software like Finotor can automate this process, ensuring your records are always up-to-date. - Can proper inventory management help me save time and money?

Yes, efficient inventory management prevents overbuying, reduces storage costs, and ensures you always have popular items in stock. By using tools like Finotor, you can automate these tasks, saving time and minimizing errors.