The Quick Ratio: A Deep Dive into Immediate Liquidity

In the dynamic landscape of financial metrics, the Quick Ratio emerges as an insightful barometer for gauging a company’s immediate liquidity. Offering a more stringent measure than some of its counterparts, this ratio is particularly cherished by chartered accountants and company managers alike. Let’s set forth on an exploration into the essence of the Quick Ratio and uncover its invaluable insights.

Defining the Quick Ratio

The Quick Ratio, often termed the Acid-Test Ratio, is a stringent test of a company’s ability to meet its short-term obligations using its most liquid assets. By excluding inventories from current assets, the Quick Ratio focuses on assets that can be quickly converted into cash.

The Formula Unveiled

The Quick Ratio is calculated as:

- Current Assets: These encompass assets expected to be converted into cash within a year, like cash, accounts receivable, and marketable securities.

- Inventories: Items that may take longer to turn into cash due to market conditions or other factors.

- Current Liabilities: Short-term debts and obligations due within a year.

A Glimpse Through a Fictional Scenario

Let’s illustrate the Quick Ratio with an example:

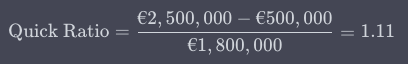

Suppose we have a tech firm based in Europe, TechEuro Ltd. The firm’s balance sheet shows current assets of €2.5 million, out of which €500,000 are inventories. The current liabilities amount to €1.8 million.

Using the Quick Ratio formula:

With a Quick Ratio of 1.11, TechEuro Ltd. possesses €1.11 of liquid assets for every €1 of liabilities. This suggests a positive position in terms of immediate liquidity.

The Chartered Accountant’s Perspective

For chartered accountants, the Quick Ratio stands out as an illuminating metric in evaluating a company’s short-term financial health. A ratio greater than 1 is a positive sign, denoting that the company can clear its immediate debts without selling inventory. Conversely, a ratio less than 1 might raise eyebrows, hinting at potential liquidity challenges.

However, industry standards play a pivotal role. A Quick Ratio considered healthy in one sector might not hold the same weight in another due to differences in business models and operations.

Steering the Business Ship: A Manager’s Insight

For managers at the helm of a company, the Quick Ratio isn’t merely a static number; it’s a dynamic tool for decision-making. Here’s how they can interpret and utilize this ratio:

- Immediate Liquidity Insights: A strong Quick Ratio underscores a company’s resilient position in the short term, ensuring stakeholders of its ability to handle unforeseen financial hiccups.

- Inventory Management: A consistently high Quick Ratio, especially when compared to the current ratio, might signal that too much capital is tied up in non-inventory assets. This could be a cue to revisit inventory management strategies.

- Risk Contingency: A low Quick Ratio serves as a timely alarm. It might prompt managers to renegotiate terms with creditors, seek short-term financing, or expedite certain revenue streams.

Financial Analysis: Beyond the Surface

While the Quick Ratio offers a snapshot of immediate liquidity, financial analysts often dig deeper. It’s imperative to consider the composition of liquid assets. If a large portion lies in accounts receivables with extended credit terms, the actual liquidity might not be as rosy as the ratio suggests.

Moreover, juxtaposing the Quick Ratio with industry benchmarks can yield more nuanced insights. A significantly higher ratio than the industry norm might hint at overcautiousness or missed growth opportunities.

In Summary: The Quick Ratio’s Impressive Stature

The Quick Ratio serves as a testament to a company’s short-term financial resilience. Its emphasis on immediate liquidity makes it a treasured metric for both chartered accountants and company managers. While it’s a valuable indicator, it’s just one piece of the financial puzzle. As always, it should be analyzed in conjunction with other metrics to glean a comprehensive financial picture.

In the vast realm of accounting and finance, the Quick Ratio stands tall, echoing the sentiments of immediate financial robustness and guiding businesses towards informed decision-making.